Delayed Gratification in Energy Savings

Written by: Jenny Lee

ENERGY COST FORECASTS

For a full-service hotel, energy costs are usually between 4 to 6 percent of revenue, but historic and luxury properties may see energy costs exceeding 10 percent. For many hotels, electricity prices have been increasing almost as fast as the gasoline prices were decreasing.

However, relief may be in sight. Wholesale natural gas prices are falling, due to the forecast of a mild winter. And, for many areas in which oil drives electricity power plants, electrical rates should stop climbing.

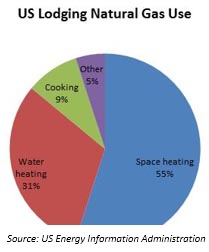

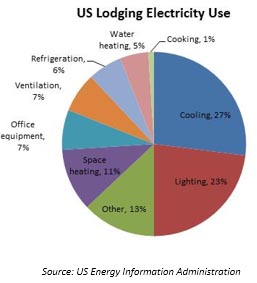

Electricity accounts for approximately 46 percent of total utility costs in a typical hotel. On average hotels in the U.S. spent approximately $2,196 per available room each year on energy.[1] With the anticipated increase by electricity companies, expect real dollar growth in electricity expense this year, but a decrease in natural gas bills. Hotels in the U.S. spent an average annual per square foot of $1.05 on electricity and $0.25 on natural gas.[2] However, most utility companies are replacing coal burning plants with natural gas. Depending on the pace at which this conversion is absorbed or passed through, the savings in Natural Gas prices should ameliorate the increase in electricity rates.

Natural Gas Savings

In late December, natural gas prices decreased to a near 2-year low as mild temperatures in the U.S. have caused natural–gas futures to fall. Record U.S. oil-and-gas production, which has played a major role in driving the crude oil prices down, is experiencing weak demand for home-heating fuels due to the recent warm spell. In December, the wholesale price of January national gas deliveries declined 30 percent.

The month of December 2014 may have been the 9th warmest month since 1950 [3], causing limited demand and allowing U.S. oil producers to work unimpeded. Unfortunately, consumers may have to wait for lower prices. Most customers are served by utilities, which buy most of their fuel in advance. If natural-gas prices remain low, most of those savings may not appear until next winter’s bills.

Natural gas for January delivery is down 32 cents at $3.144 a million British thermal units on the New York Mercantile Exchange. The price of the fuel has dropped 30 percent in December.[4]

[1] U.S. Energy Information Administration and Infogroup ORC on Demand Research

[2] E Source Companies LLC.

[3] MDA Information Systems LLC, December 2014

[4] Ira Iosebashvili, “Natural-Gas Prices Drop on Mild Weather”, Wall Street Journal (December 22, 2014)

US Lodging Electricity Forecasts

U.S. electricity rates increased after years of slow growth, driven by large increases in the Northeast. U.S. electricity prices experienced the largest jump in 5 years during the first 6 months of 2014.

The U.S. Energy Information Administration estimates residential prices in 2014 to have increased by 3 percent over last year’s levels. Average U.S. residential electricity prices are expected to grow at a slower pace at 1.7 percent in 2015.

For a state-by-state changes in the average retail price of electricity, go to:

http://www.eia.gov/electricity/monthly/epm_table_grapher.cfm?t=epmt_5_6_a

Note that Hawaii has the highest average electricity rates, commanding more than triple the national average, while New York and California’s average electric rates are approximately 50 percent more than the national average. Washington D.C. and New Jersey command rates 20 percent more than the average.

As you are reviewing variance reporting, you will need to research your local energy company, or companies, to anticipate increase in rates. Utility forecasts for major markets are shown below, from worst to least:

- In New England, National Grid increased their rate by 37 percent in November 1, 2014 and NStar has requested a 29 percent increase effective January 1, 2015 due to the coal- and oil-fired power plants that have closed. Now the region is dependent on natural gas for generation but has limited infrastructure to get the gas to markets. No savings are likely until budget season next year

- National Grid, which supplies electricity to 3.4 million customers in northeastern US, is seeking to increase electric rates by 23.6 percent as of December 2014. Note that many regional utility companies have filed for increases because of constraints on the gas pipeline that strain the price of electricity generation. Ditto for waiting for any relief until 2016.

- Texas, which reaped the benefits of complete deregulation and variable pricing with four consecutive years of cost declines, will likely see substantial increases in rates during peak demand period. Its utility commission authorized a 40 percent increase in the highest demand period pricing in June, 2014, and will increase the rate cap by an additional 28.5 percent in June, 2015. Texas has a system whereby CenterPoint, the owner of the grid, prices its service separately from the energy generating company, for which it earns 30 to 40 percent of the amount billed. CenterPoint’s return is currently above the 10 percent guidance authorized by the utility commission and in October a number of Cities banded together to challenge CenterPoint’s return.

- Chicago based Com Ed also got out of the energy generating business, and now bills separately for electricity and the cost of delivering it across its power grid. The transmission cost accounts for approximately 40 percent of a customer’s bill. In order to finance a $2.6 billion grid modernization, the transmission component increased by approximately 38 percent, and the average consumer’s utility bill grew by 21 percent back in June. Increased transmission costs will cause the average consumer’s bill to grow by an additional 3.7 percent in January, 2015.

- In Southern California, Edison, which serves much of Southern California, increased residential rates across the board last month, with average users seeing their bills increase by 8 percent. An article recently published in the LA Times, cites a study that predicts the cost of electricity could jump 47 percent over the next 16 years, in part due to the state’s shift toward more expensive renewable energy.

- San Diego Gas & Electric seeks a 7.5 percent rate increase in 2016, according to filings submitted in November 2014.

- Xcel Energy, which serves Denver will charge 4.9 percent more in 2015 to recover the cost of replacing coal-fired plants and meet the state’s goal of an 80 percent reduction in emissions.

- Hawaii, which recently experienced a rate adjustment in mid-2014, has committed to no further rate hikes for the next 3 years until 2017. Almost all of Hawaii’s electricity is produced with oil, not coal. There may be some rate reductions in the future, if the Utility commission does not spend the windfall on its green (solar) energy goals.

- Florida Power & Light forecasts a decrease in commercial electricity cost of one percent for 2015.

What should ultimately result in savings may be wiped out by environmental compliance. Although, natural gas prices are decreasing, “we are now in an era of rising electricity prices“, according to Philip Moeller, a member of the Federal Energy Regulatory Commission. The problems confronting the electricity system are the result of a wide range of issues including new federal regulations on toxic emissions, rules on greenhouse gases, state mandates for renewable power, and technical problems at nuclear power plants.

About the author:

Jenny Lee is a Vice President with Pinnacle Advisory Group West based in Southern California. Prior to joining Pinnacle, Ms. Lee was the founder of Hospitality Research Solutions, and employed at Jones Lang LaSalle, and Economics Research Associates (“ERA”). Ms. Lee holds a Bachelor of Science degree from the School of Hotel Administration at Cornell University and a MBA from The University of Chicago Booth School of Business with coursework concentration in marketing and finance.