Article for HNN – Silicon Valley Hotel Outlook: Darkest Before the Dawn Reliance on Tech Industry Struck Market Hard in 2020 – by Karen Johnson, ISHC, & Lana Yoshii

Tech companies were among the first employers to cancel meetings and halt travel as news of COVID-19 emerged from China.

After first restricting international travel in February, most companies had restricted nonessential domestic travel by early March. Amazon and Facebook were conducting job interviews by video calls, and Twitter issued work-from-home orders well before counties issued shelter-in-place orders on March 16.

How bad was it, on a macro level?

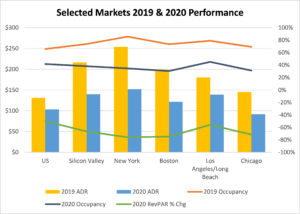

The U.S. hotel industry finished 2020 with a 50% decrease in revenue per available room versus 2019 results. While a 67% decline in Silicon Valley was significant, when stacked up against some U.S. hotel markets, Silicon Valley did not fare that badly. Hotel RevPAR in New York, Boston and Chicago declined between 72% and 76%. Despite the dive in occupancy, Silicon Valley “only” discounted rates by 35%, compared to 40% in New York, 39% in Boston, and 37% in Chicago.

click on image below to enlarge:

NOTE: Based on total rooms inventory: all temporarily closed hotel rooms supply calculated as if they were open.

Source: STR, compiled by Pinnacle Advisory Group, West.

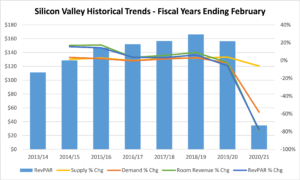

Looking at the trailing 12-month periods ending in February, Silicon Valley’s hotel market peaked with a 3% increase in demand, exceeding the 2.7% increase in supply, with an impressive 8.9% increase in room revenue, resulting in RevPAR of $166.27 at the peak. Though the market posted a 3.8% increase in hotel supply for the 12-month period, demand fell by 2.8%, resulting in a 5.9% decline in RevPAR for the core cities in Silicon Valley.

How to explain the pre-COVID-19 decline in demand, given that the tech industry was booming? The softening in demand started in April 2019 as price resistance accelerated. Travelers looked to lower cost markets in the East Bay area or made day trips.

With Silicon Valley hotels allowed to serve only essential workers, occupancy in the market dove to 16.3% in April, and averaged 33% for the 12 months ending February 2021. Demand was reduced by 59%, and rates were slashed in half, resulting in average RevPAR of $34.60.

click on image below to enlarge:

NOTE: Data is based on the 12 months ending February for each reporting year. Based on total rooms inventory: all temporarily closed hotel rooms supply calculated as if they were open.

Source: STR, compiled by Pinnacle Advisory Group, West.

The shelter-in-place order continued to be in effect until the end of May 2020, but by then, the tech companies of Silicon Valley had figured out a gameplan for maintaining productivity during the pandemic.

In mid-May 2020, Google and Facebook announced employees would be allowed to work from home for the remainder of the year. By the end May, 95% of Facebook’s employees were working off-campus. By early November 2020, all of Alphabet’s 200,000 employees and contractors were working off-campus, and they are expected to continue to do so until June 2021.

However, hardware-centric companies such as Apple had announced their slow phasing in of employees back into the office. These tech companies had redesigned their offices to provide one-way routes through the office, staggering work-stations, and limited in-person meetings as they had planned a “working during COVID” environment.

In January and February of 2021, the Valley sold an average of 302,800 hotel room nights, up from an average of 181,100 from March to June of 2020. Slowly, demand is improving.

Long term, Facebook has even predicted that 50% of its workforce will work remotely within the next 10 years. As Facebook continues to hire new employees, many have been in remote positions in areas surrounding existing offices to create hubs in geographically dispersed locations across North America. Twitter and Square offered permanent work-from-home options to employees. Zapier, a Silicon Valley startup even offered tech workers a $10,000 stipend to leave the Bay area and work remotely. Google is betting that some combination of remote and office work will predominate and announced this month that they are investing $1 billion in California, including the expansion of their Mountain View headquarters.

Much has been published on a recent exodus of tech workers from the Bay Area, but this seems to be exaggerated. A recent analysis of the U.S. Postal Service’s change of address notices indicated that there was a net loss of 53,000 households from the City of San Francisco. However, about 28,000 of those households moved to another Bay Area county, which means a net loss of 25,000 households — only 0.7% of total households.

It is not known yet if the moves by Oracle and HP’s Business Enterprise division will turn this trickle into a stream or river. Will there be other employers? The Bank of Silicon Valley tracks venture capital fundraising and observed that venture capital firms are sitting on enough cash to fund one and a half years of investment at the long-term average spend level. Nearly $160 billion was raised in 2029, which is a record high.

But where will these jobs and this hotel demand be created? Bank of Silicon Valley also tracks that. The Raleigh, Austin and Nashville markets appear very attractive in most metrics, with the exception of tech talent.

Venture capitalists have been on a spending spree, investing in Raleigh-based tech startups at a three-year compound annual growth rate of 36%. Washington, D.C., is the second-hottest area, where tech investment has been growing at a compound annual growth rate of 16%, followed by Denver and Nashville both at 12%.

The thing about percentages is that it is easier to show high numbers on a small base. The Bay area, with the preponderance of tech jobs, is still turning in a respectable 8.% compound annual growth rate in venture capital investments. Only in the tech world is an 8% compound annual growth rate a small number. The Silicon Valley is to tech what Los Angeles is to entertainment and New York is to finance.

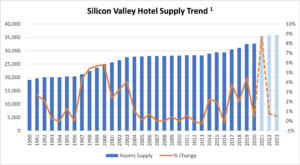

While waiting for the market to recover, however, existing hoteliers will also have to contend with the 18 hotels, totaling 3,100 rooms, currently under construction. Many slated to open in 2020 were delayed, and the vast majority of those rooms are currently slated to open this year. If the announced openings occur, supply will grow by 8.7% by the end of the year — twice the recent year’s average.

click on image below to enlarge:

1 This table includes only hotels under construction, not include projects in planning.

Source: STR, Pinnacle Advisory Group West

The Silicon Valley is a corporate market, with little weekend demand. Its largest employers set travel norms for smaller employers. The pace of recovery in the Silicon Valley will be determined by the tech giants’ relaxation of travel prohibitions, which may change with vaccination progress. The medium- and long-term prognosis is good. At present however, it appears hoteliers are due for another miserable year.