Bad vs Horrible – Depends on How Performance is Measured. by Allison Fogarty

The importance of considering Total Rooms Inventory (TRI) in measuring Lodging Industry performance.

Through the pandemic, hotel Occupancy rates have hit historic lows throughout the country. We have constantly been asked “how bad is it?” Reports early in the pandemic, while awful, seemed to actually understate the catastrophic effect of the pandemic on the hospitality industry. We studied figures provided by STR and other industry analysts and questioned their representatives to fully understand reporting methodologies in an effort to truly understand the current situation in the lodging industry.

Unfortunately, the industry’s standard measure of capacity utilization – Occupancy – is traditionally based on the number of available rooms in a market divided by the number of occupied rooms. This standard methodology is based only on hotels that are open and operating, so if hotels have been closed either due to government restrictions or lack of guests rendering operation uneconomic, rooms at temporarily closed properties are removed from the inventory of available rooms.

Earlier this year I, along with my colleagues at Pinnacle Advisory Group, was puzzled when occupancy levels in some local Florida markets – Miami and Orlando in particular – were higher than expected given the cities’ dependence on mass tourism and conferences. The mystery was solved when I realized that hotels that had closed were not included in standard occupancy statistics. Additionally, in some markets where new hotels have been added during the pandemic, the supply and demand picture is further complicated. In the standard occupancy calculation, temporary closures disguise the true impact of additions to supply during the pandemic, as permanent supply increases may be masked by offsetting temporary closures.

STR, the lodging industry’s statistical data guru, recently began to provide an alternate occupancy measure based on the Total Rooms Inventory (TRI) in a market, which counts temporarily closed rooms as part of the denominator, reducing Occupancy. In general, the percentage difference in Occupancy between the two Occupancy calculation methods is the same as the percentage difference in supply between the two methods. As properties reopen (or close permanently), the standard and TRI occupancies will trend together.

Standard occupancy calculations make sense in benchmarking individual properties, as hotel managers should compare their hotels against other open properties. For analysts concerned with the bigger picture, and those that are trying to determine when it may be worth re-opening, the analysis is more nuanced. Total Rooms Inventory (TRI) Occupancy allows corporate staff and analysts to understand the true supply and demand picture, as presumably when the market returns to “normal”, many of the temporarily closed rooms will reopen, competing for available demand.

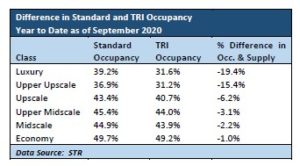

Luxury and upper upscale properties, many of which are reliant on group demand, are overrepresented among closed properties nationwide. On a year to date basis as of September 30, over 19% of luxury rooms, and over 15% of upper upscale rooms were closed during the first nine months of the year, while only a small percentage of economy rooms were shuttered. Many hotels have reopened, but 11.7% of luxury and 12.0% of upper upscale hotels remained closed in September. The flowing chart highlights the difference between standard and TRI Occupancy measures, and hence the percentage of rooms closed by hotel classification.

click on image to enlarge:

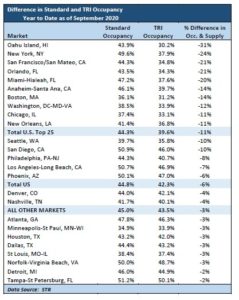

Closures have unequally affected markets across the country. Cities known as the first epicenters of the pandemic (including New York, Miami and Boston), large convention destinations (such as Chicago, Orlando, and New Orleans) and cities reliant on air-based leisure travel (Oahu and Orlando) have among the most significant discrepancies between standard and TRI occupancy. Based on STR figures as of September year to date, of the nation’s top 25 markets, Oahu Island, Hawaii had the largest discrepancy between the two occupancy measures and hence the greatest percentage of closed hotel rooms, while Tampa Bay, Florida had the fewest shuttered rooms. Among the nation’s top 25 markets, New York, Orlando, and San Francisco had the most shuttered hotel rooms, while Norfolk -Virginia Beach is the only top 25 market where all hotels are reportedly open.

The following chart details the difference in year to date occupancy between standard occupancy measures and the TRI occupancy when all the rooms in the market, including those that are temporarily closed are counted.

click on image to enlarge:

“How bad is it?” Well, its bad all over, but in some of the smaller markets: the Tampa Bay area, Detroit, and Norfolk/Virginia Beach, as of September, most rooms in the market were open, and the TRI RevPAR decline was lower than the national average of 49.5%. In other major markets, including New York, San Francisco, Chicago and Boston, a significant percentage of the supply is currently off the market, and TRI RevPAR has declined by over 65%, indicating that the path to normality is likely to be steep and bumpy as hotels in these markets reopen, diluting available demand.

About Pinnacle Advisory Group

Since 1991, Pinnacle Advisory Group has provided advice and analysis on the full spectrum of hospitality properties throughout the US and Caribbean in all phases of the economic cycle. Pinnacle’s services span investment advisory, market and financial feasibility analyses, valuation, litigation support, asset management services, receivership, development consulting, and strategic planning. Our clients include major banks, leading hotel companies, REITs, universities, and municipalities. Our seasoned professionals have diverse backgrounds encompassing operations, strategic planning, real estate appraisal, and consulting.

About the Author

Allison Fogarty is the Managing Director of Pinnacle Advisory Group’s Florida and Caribbean Practice Group. Ms. Fogarty has extensive experience in strategic planning, and financial analysis and operational oversight in the hotel industry. Her corporate activities have included site selection, property inspection, contract negotiation and review, and due diligence. As a consultant, she has directed and completed market and financial analysis engagements and investment counseling for hotels and resorts in the eastern United States and the Caribbean.