Boston and Cambridge Lodging Market: Navigating Post-Pandemic Realities and Future Prospects – by Rachel Roginsky, ISHC

The Boston and Cambridge lodging market, one of the most vibrant and dynamic in the United States, has undergone significant changes in recent years. These changes, spurred by external factors like the COVID-19 pandemic, economic fluctuations, and evolving consumer preferences, have created a complex landscape for hoteliers and investors alike. This article delves into the current status of the Boston/Cambridge market, examines historical data and trends, and offers short term projections for the future.

Historical Overview: A Market Shaped by External Forces

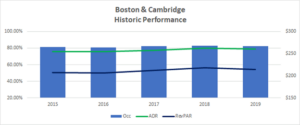

Pre-Pandemic Growth and Resilience (2015-2019)

In the years leading up to 2020, the Boston/Cambridge lodging market was characterized by robust growth and strong performance metrics. The market was supported by a thriving economy, with Boston’s position as a leading center for education, healthcare, and technology driving consistent demand for hotel rooms. The local office markets were healthy, the convention calendar was robust, and tourists flocked to the City to visit the abundance of tourist attractions. The Cambridge area, in particular, benefited from its proximity to prestigious institutions like Harvard University and MIT, attracting a steady stream of academic and business travelers, coupled with a thriving office market.

Occupancy rates during this period consistently remained above 80%, reflecting the market’s ability to absorb new hotel supply without significant drops in performance. The introduction of several high-end properties, including boutique hotels and luxury chains, further diversified the market, catering to a wide range of traveler preferences.

Please click on the image below to view:

Source: Pinnacle Perspective

The Disruption of COVID-19 (2020-2021)

The onset of the COVID-19 pandemic in early 2020 brought unprecedented challenges to the lodging industry, and the Boston and Cambridge markets were no exception. Occupancy rates plummeted as travel restrictions and lockdowns took effect, leading to a sharp decline in business, group and leisure travel. Hotels faced significant financial strain, with many reducing operations or closing temporarily.

The impact was particularly severe in the Boston area, where large conventions and events, traditionally major drivers of hotel demand, were canceled or postponed indefinitely. Office workers stayed home given the severe business travel restrictions. Universities converted to School From Home. The lack of international tourists further compounded the problem, as Boston’s historic sites and cultural attractions typically draw significant numbers of visitors from abroad.

Recent Developments: Recovery and Resilience

Gradual Rebound (2022-2023)

As the global situation began to stabilize in 2022, the Boston and Cambridge lodging market showed signs of a gradual recovery. While the road to recovery has been uneven, with occupancy rates remaining below pre-pandemic levels, there have been many positive developments. The return of business travel, although not at full capacity, and the resumption of events have provided a boost to the market.

Please click on the image below to view:

Source: Pinnacle Perspective

Projections: The Lodging Market Continues to Advance

Short-term Outlook (2024-2025)

In the short term, the market is expected to continue its recovery, although at a measured pace. Occupancy rates are not expected to reach their pre-pandemic levels of 81%-82% in 2024 and 2025. There are several key factors that will aid in the continued recovery which include: 1) the return of large-scale events and conventions, which are crucial drivers of demand in the Boston area, 2) slow and steady improvements to the City’s office market, 3) strong leisure demand especially with the more affluent travelers, 4) a number of key events that are scheduled to occur in Boston’s shoulder and slow seasons, and 5) a record-setting number of passengers at Logan Airport. And maybe even another great year for the Celtics and the Bruins!

The ADR is also anticipated to improve, although the increases will be at a decelerating rate. Fewer compression nights, economic issues impacting discretionary spending, and hotel rates that are considered high as compared to other urban markets contribute to the slowing of rate growth.

Please click on the image below to view:

Source: Pinnacle Perspective

Challenges and Risks

Despite the optimistic outlook, there are some risks that could impact on the market’s trajectory. Furthermore, there are a number of challenges facing the local lodging market that could impact hotel profits. Below are a few key challenges and risks:

- Nov. Election – impacts stability local, national and international visitation.

- Union Contract – currently under negotiation with potential to disrupt operations and puts pressure on wages.

- Health and safety ordinance – currently under consideration and could drive up operating costs.

- Hynes renovation -the long-term renovation limits room nights with partial shutdowns.

- Labor shortage – particularly in roles such as housekeeping and food services, remains a persistent challenge that could affect service quality and operational efficiency.

- BCEC – although a record year is expected in 2025, there continues to be less compression given new supply in the Seaport, along with the calendar of events and size of groups on peak.

- Economic issues – inflation, the potential for a recession, higher interest rates, and higher prices for supplies continue to pose uncertainty.

- Limited hotel supply – could impact the ability to sell to groups.

- Leisure travel – leisure demand has plateaued and will potentially be more rate-sensitive.

Conclusion: A Market in Transition

The Boston and Cambridge lodging market is improving while at the same time, adjusting to the new norm in a post covid environment. The market is emerging from the challenges of the past few years with a renewed focus on innovation and adaptability. While the path to full recovery is still a few short years away, the market is showing resilience and is well-positioned to capitalize on new opportunities. The next few years will bring both challenges and opportunities, but with careful planning and strategic investments, the market is set to thrive in a post-pandemic world.

ABOUT THE AUTHOR:

Rachel Roginsky, ISHC, is the owner and founder of Pinnacle Advisory Group. She is based in the firm’s Boston office. Roginsky has more than 40 years of experience in hospitality consulting. In 1991, Roginsky founded Pinnacle Advisory Group. Roginsky provides hospitality operational, investment counseling and advisory services to corporate, institutional, and individual clients on all facets of hospitality real estate. She also serves as board member to numerous hospitality-related organizations and societies, and is a regular guest lecturer at prestigious institutes of higher education. Additionally, Roginsky is an adjunct professor at Boston University School of Hotel Administration. She is widely published and quoted, and is the co-editor and author for Hotel Investments: Issues and Perspectives, a well-regarded book (5 editions) published by the Educational Institute of the American Hotel and Lodging Institute.