BOSTON/CAMBRIDGE LODGING MARKET – 2023 YEAR END REVIEW, By Rachel Roginsky, ISHC

The Boston/Cambridge lodging market ended 2023 at 76.4% occupancy, a 6.8% variance over 2022’s 69.6%. This 6-point increase in occupancy is a result of the market accommodating 8.6% more rooms in 2023 compared to the prior year; 0.6% more rooms occupied as compared to 2019. Seasonality appears to be in sync with what we typically expect for the Boston market. Peak season, May through October, monthly occupancies ranged between 84% and 89%, averaging 86%. The three-month shoulder season, March, April and November, market occupancy averaged 75%. December through February, our slow season, market occupancy averaged 58% in 2023. Finally, in terms of the 2023 market demand mix, and based on data provided by hotel managers in the City, the group, contract, transient leisure, and transient corporate mix was 22%, 6%, 45% and 27%, respectively. This compares to an estimated demand mix for 2022 of 22%, 6%, 42%, and 30%, respectively. Clearly the most significant change was the shift within the transient segment where transient corporate demand increased as the corporate market continues to ramp up from the impact of the pandemic.

Overall, ADR increased by 4.7% in 2023 over 2022. However monthly ADR growth declined from very high rates growth in the early part of the year. In the first five months of 2023, room rates grew at an average rate of 12.8%. This compares to an average growth rate of 4.0% for the remaining 7 months of 2023. In fact during the summer months (June/July/August) rate growth slowed even more (an average of 2.6%) which can be attributed to leisure travelers considering alternative locations and not willing to pay significantly more for rooms in the Boston market.

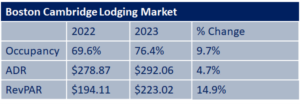

With both strong occupancy and room rate, the Boston/Cambridge RevPAR reached $223.03 in 2023, up 14.9% from the 2022 level, and surpassing 2019 levels by 4.0%. Clearly hotel operators and owners in the City are more optimistic and most believe that the subject lodging market will continue its upward trajectory.

Presented in the table below are the year-end 2023 vs. 2022 statistics for the Boston/Cambridge lodging market.

click on image below to enlarge:

While the 2023 occupancy and ADR for the City have been strong, the actual performance for hotels within the submarkets differs. For example, if we look at geographic submarkets, the Logan Airport submarket achieved the highest occupancy in 2023, reaching 84.6%. This submarket also garnered the strongest rate growth, increasing 10.2% in 2023 compared to 2022. With room rates lower in this submarket as compared to other submarkets, the 2023 RevPAR of $188.95 placed this submarket as the 2nd lowest in the City. The second strongest geographic areas in terms of occupancy were Fenway/Longwood Medical Area (LMA) and North End/West End, both ending the year at approximately 80%. Cambridge had the lowest annual occupancy, at 71.5%. Pre-covid, the Cambridge lodging market performed at an occupancy level slightly below the overall Boston/Cambridge lodging market (2019: Cambridge 81.75% vs Total Boston/Cambridge 82.5%). Unfortunately the Cambridge submarket is still ramping up. According to CBRE’s fourth-quarter Cambridge office report, office demand from tech companies in Cambridge contracted by more than 85% from 2019 to the end of last year. In terms of RevPAR, the top three submarkets with the highest RevPAR were North End/West End, Downtown and Back Bay.

Looking at operating performance by rate tier also shows varied results. For example, occupancy in the luxury tier in 2023 was only 58.7%. While this tier typically operates with lower occupancy, it clearly is taking more time for the ultra-high rated hotels to gain traction. Furthermore, our newest hotel, Raffles, which opened towards the end of 2023, will add for luxury inventory to the City in 2024. With respect to room rate, the ADR for this rate tier was $596.45, a 2.9% decline from 2022. Regardless of the drop in ADR, the luxury tier RevPAR ended the year at $344.59, a 16.7% increase over prior year performance. The two lower rate tiers in the City achieved the highest occupancy (79%) with room rates and RevPAR averaging approximately $234.84 and $186.82, respectively.

With a very good year behind us, there is much to be optimistic about as we move into 2024 although the hospitality industry has become accustomed to surprises. Nevertheless, all signs point to a healthier lodging market in Boston/Cambridge in 2024.

About the Author

Rachel J. Roginsky, ISHC, is the Owner and Founder of Pinnacle Advisory Group. She is based in the firm’s Boston office. Ms. Roginsky has more than 40 years of experience in hospitality consulting. Ms. Roginsky is an appointed board member of The Cornell Center for Real Estate and Finance (CREF), and is the current Chair for Boston University School of Hospitality Administration’s Real Estate Advisory Council (REAC). She also serves as a board member to numerous hospitality-related organizations and societies, and is a regular guest lecturer at prestigious institutes of higher education. Additionally, Ms. Roginsky is an adjunct professor at Boston University. She is widely published and quoted, and is the co-editor and author for Hotel Investments: Issues and Perspectives, a well-regarded book (5 editions) published by the Educational Institute of the American Hotel and Lodging Institute.