Despite Surge in Demand, Boston Lodging Market’s 2016 RevPAR Flat, by Sebastian Colella

Economic uncertainty contributed to the United States lodging market’s softening in 2016. The Boston and Cambridge lodging markets were no exception. STR has projected the country’s revenue per available room (RevPAR) to increase 3.1% in 2016, its slowest growth since the recession. After five consecutive years of considerable RevPAR growth, the Boston lodging market is expected to experience no change in RevPAR from its banner year in 2015. While the market did not outperform the prior year, there were some positive take-aways on the year and some indicators which should provide for a more optimistic 2017.

Year in Review

Based on preliminary performance figures, the Boston lodging market experienced an increase of 3.7% in demand in 2016. Although accommodating approximately 250,000 more roomnights than 2015, occupancy declined as new supply outpaced demand, increasing 4.6%, its largest increase since 2003.

The first quarter was negatively impacted when compared to 2015 by the region’s mild winter and a quiet convention calendar. During these same months, three new hotels entered the market and a fourth completed a guestroom expansion. Corporate transient demand began to slow in the second quarter, a trend which was consistent through most of the year. As this higher rated demand declined, operators relied more heavily on OTAs and lower rated leisure segments in the summer and fall months, and in some cases contract and government segments. This shift in market mix lowered average daily rates (ADRs) and restricted the market from driving rates. Further, AirBnB and other home sharing services have made it difficult to charge a premium on compression nights which allow for substantial rate growth. In the third and fourth quarters, two new hotels opened in Cambridge, bringing the total new rooms in 2016 to 1,063.

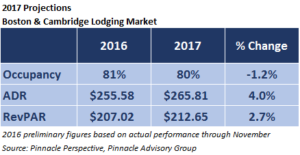

Considering the market’s performance in 2015 which had everything working in its favor, the additions to supply and the softening corporate segment in 2016, the Boston market fared well. Preliminary figures indicate the local lodging market will have an occupancy of 81.0% in 2016, declining half a point from its level in 2015. ADR, which grew 9.0% and 6.4% in 2014 and 2015 respectively, is expected to increase 0.6% in 2016.

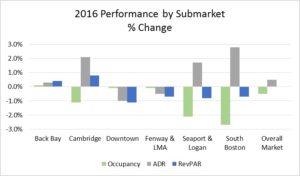

Of the six submarkets tracked by Pinnacle Advisory Group, the Back Bay was the only submarket that experienced a lift in occupancy, an increase of only 0.1%. The most significant decline in occupancy was felt in the South Boston submarket, declining 2.7% primarily as a result of the new supply in the Seaport District and operators efforts to drive rates. Both the Downtown and Fenway submarkets experienced declines in ADR in 2016. The only submarkets with increases in RevPAR were Cambridge and the Back Bay which increased 0.8% and 0.4%, respectively. The other four area’s had declines in RevPAR ranging from 0.7% and 1.1%. The 2016 performance for each submarket compared to 2015 is presented below.

The Year Ahead

Although it is unclear how the incoming administration could impact the economy or how the strong dollar and Brexit may impact international travel, Boston’s demand growth is projected to continue in 2017 though at a slower pace. The following facts are expected to impact the Boston lodging market in the next 12 months:

- Compared to the 4.6% increase in supply experienced in 2016, there is little new supply scheduled to enter the market in 2017; a 326-room Yotel in July and a 60-room expansion at the Holiday Inn Express South Boston expected to be completed by yearend.

- The five properties which opened in 2016 will no longer be in their first year of ramp up with discounted rates and heavy reliance on OTAs. In turn, these properties should not contribute to bringing down rates in their respective submarkets and instead may be more competitive as their properties reach stabilization.

- Traffic through Boston Logan International Airport increased 5.7% in 2015 and is expected to increase over 8.0% in 2016 reaching a historic high of over 36 million passengers served. International traffic at Boston Logan increased 10% and 11% in 2014 and 2015 respectively and is expected to increase over 18% in 2016. Although adding additional airlines and routes in 2017, without expansions of its facilities, maintaining these high growth rates may prove difficult.

- According to the Pinnacle Advisory Group Booking Pace, it will be a slow start to the year with January and February pacing behind approximately 25,000 roomnights compared to the prior year. However, nine of the ten remaining months of the year are expected to outpace the 2016 booking pace, combined for an increase of 3.0%. Furthermore, peak group months fall in May and October, two strong transient months which should allow operators to drive rates.

- Unlike 2016 when national holidays fell on dates which negatively impacted hotels, this year’s calendar should allow for both demand and rate growth. For example, Easter weekend and the Boston Marathon overlap (similar to 2014) and the National Education Association citywide held at the BCEC overlaps with the week of July Fourth, another slow holiday for the market.

Pinnacle Advisory Group has projected demand to increase approximately 1.0% with occupancy to follow a similar pattern seen the last two years, declining one point to 80%. ADR is expected to again be the driver in RevPAR, increasing 4.0%. The market’s resulting RevPAR is projected to increase 2.6%.

Long-term prospects for the overall Boston lodging market are positive. Despite the risk of new supply and the continued increases to operating costs, the city’s positive fundamentals are expected to drive demand. Boston is, and will continue to be, one of the strongest lodging markets in the country as a result of it diverse demand base and high barriers to entry. Despite the uncertainties facing the both the United States and the international economy, long term prospects for the Boston market are encouraging.

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

About the Author

Sebastian Colella is a Vice President with Pinnacle Advisory Group’s Boston office. Responsible for assignments in urban and suburban markets throughout the country, his primary focus is on the Greater Boston market. Sebastian holds a Bachelor of Science degree from the School of Hotel Administration at Cornell University with industry experience in both sales and operations roles at hotels, resorts, and private clubs.