Downtown Los Angeles – “The Next Great City” written by: Sandra Lien

Fifteen years ago, Downtown Los Angeles was best described as an urban wasteland, with 28 million square feet of available office space, an under-utilized convention center, and 10 struggling hotels surrounded by 30 acres of mostly vacant retail space, cheap motels (SROs), bars, strip clubs, and vacant lots. The daytime population was not much beyond office workers, pensioners, homeless, and semi-homeless hotel dwellers, and the streets of Downtown were virtually deserted after working hours. Even as recently as 2014, The Guardian reported that the residents of Skid Row made up over 33% of Downtown’s residential population.

Today, the scene is continually evolving with the constant surge of new development projects – as evidenced by the number of construction cranes dotting Downtown’s horizon. Whereas initial development in the early 2000s was in compact, neighborhood-centric hubs, it is now evident that development is taking place in nearly every Downtown district. The projects vary in size, character, and scope from three parks underway in the Arts District, Chinatown, and the Civic Center, to the seven mixed-use mega-projects proposed/under construction in five different neighborhoods – most of which carry circa $1 billion price tags.

Housing developments (condos and apartments) remain the anchor to Downtown LA’s evolution, which is largely in response to the Millennials’ desire to forego suburbia for a “live, work, play” environment that is also changing the character of many other downtowns throughout the nation. Currently, there are more than 10,000 Downtown residential units under construction and another 15,000 units proposed and in various planning stages through 2017.

Economy

All sectors are reporting strong growth:

- Downtown apartment rents were up by 6.1% in Q4 2015 to an average of $2.78 per square foot, according to CoStar data, and rental occupancy rates are over 95% despite the entry of more than 1,900 units to the market over the last year.

- According to Cushman & Wakefield, Downtown office vacancies have improved by over a percentage point from last year, to 18.2%. Total office leasing activity in 2015 amounted to 2.4 million square feet, and Class A space rents for nearly $3.25 per square foot (up from $3.21 per-square-foot last year). Approximately 2.5 million square feet of space is currently under construction, and another 225,000 square feet is proposed.

- CoStar reports Downtown retail vacancies are at 4.8% at asking rents approximately 5% up from last year. Net absorption amounted to over 640,000 square feet in 2015. Approximately 2 million square feet of retail space is currently under construction, with over 1.1 million more square feet planned.

- At the end of 2015, Downtown LA hotel RevPAR was up by over 9% from 2014 due to strong ADR growth of 7.5%. More recent data through the end of February 2016 indicates that Downtown’s RevPAR is still growing strong, up over 21% from the same period last year (occupancy is up by 8%, while ADR is up by over 12%). We have identified some 5,500 rooms in various planning stages; approximately 2,500 rooms are already under construction (as will be detailed later), which will increase Downtown’s available inventory by just over 30%.

The Rise of Mega-Projects

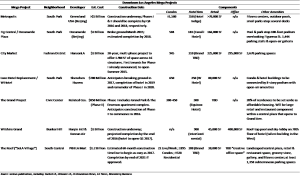

Despite a few high-profile projects at or nearing completion by the end of the year (Eli Broad’s $140 million art museum in Bunker Hill, Carmel Partners’ 700-apartment Eighth and Grand/Whole Foods project in the Financial District, and the $180 million transformation of the former Macy’s Plaza to “The Bloc”), the real activity is just beginning. Especially in the South Park neighborhood, which will be home to three new mega-developments of approximately $1 billion each that will result in a collective 10 new high-rise structures. These developments (backed by Chinese companies) are profiled in the table that follows, along with four other high-profile mega-projects that are in different phases of construction/planning:

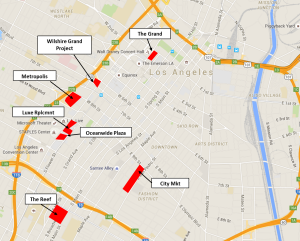

As the following map shows, these mega-developments should extend the boundaries of “mainstream LA” further south, and further east:

The southern end of Broadway is becoming another centric Downtown hub, with multiple housing developments proposed near the relatively new Ace Hotel. Information published by LA Downtown News highlights that the Arts District is also booming, and projects such as the Soho House indicate that the action has “jumped” Seventh Street and the community is expanding further south.

Lodging Industry Outlook

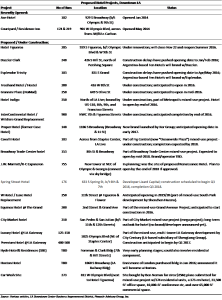

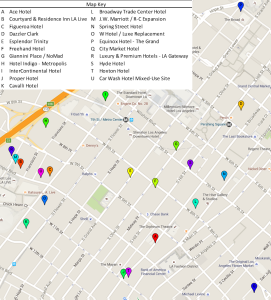

As previously shown, each Downtown LA mega-development will have its own hotel centerpiece. However, combined with the “one-off” projects not planned as part of a major mixed-use development, we have uncovered the following hotels proposed/planned/under construction in Downtown LA, which reveals that Downtown’s lodging inventory will increase by at least 30% by the end of 2018 (assuming no other project commences construction):

We present all of Downtown’s proposed lodging supply (including the most recent openings) on the following map:

In Other News…

Downtown’s renaissance has not been without its disappointments. In March 2015, AEG officially ended its efforts on the proposed 72,000-seat Farmers Field stadium intended for a 15-acre site immediately west of the Staples Center. The NFL approved the owner of the St. Louis Rams to relocate the franchise to a suburban site in Inglewood.

Aside from the failed attempt to bring an NFL franchise to Downtown, the LA Convention Center will be undergoing a massive $350 million renovation effort; in June 2015, the city selected its architect. The design features a new ballroom on top of the venue with a newly built structure that bridges over Pico Boulevard, thus creating the contiguous space that was lacking in the Center’s former two separated structures. The Pico building will have multiple floors of meeting space that line an open-air courtyard, and the West Hall will be reconfigured as a large outdoor ballroom space with a grand staircase to draw people in from Gilbert Lindsay Plaza just south of the Staples Center. Meanwhile, operator AEG is currently implementing other upgrades to the tune of $10 million.

Lastly, Downtown LA could play a key role if Los Angeles (declared the front-runner over Boston) is selected to host the 2024 Olympic Games. The draft $4.1 billion plan in the city’s draft bid projects that the Games would generate an approximate $161 million surplus. Downtown LA would offer venues in two primary hubs: one near LA Live, and one centered on Exposition Park and USC. By then, the new $250 million soccer stadium (planned by the as-yet-unnamed LA Football Club of Major League Soccer) at the current site of the Los Angeles Memorial Sports Arena will have been operating for approximately six years and will serve as one of the newer venues.

About the author:

Sandra Lien is a Vice President with Pinnacle Advisory Group, Inc. based in Southern California. Ms. Lien has over 10 years of hospitality real estate consulting experience. She has performed valuations and advisory assignments for a wide variety of hospitality product types in various locations throughout the United States and Mexico, including golf courses and resorts, casino hotels, convention centers/conference hotels, airport hotels, mixed-use developments, condo-hotels, fractional/timeshare projects, luxury destination resorts, and boutique properties. Ms. Lien holds a Bachelor of Science degree from the School of Hotel Administration at Cornell University.

About Pinnacle Advisory Group:

Since 1991, Pinnacle Advisory Group has provided advice and analysis on the full spectrum of hospitality properties: hotels, resorts, conference centers, mixed use projects, convention centers and exhibition centers. Pinnacle’s services include development counseling, appraisals, acquisition due diligence, asset management and litigation support. Clients include leading hotel companies, REITs, universities, major banks and municipalities. Pinnacle specializes in providing personalized advice on complex projects, carefully tailoring services to each client’s individualized needs.