Hotel Operators Cautiously Plan to Reopen in Boston & Cambridge Amid Coronavirus Concerns – by Rachel Roginsky, ISHC and Sebastian Colella

During the early stages of the ongoing pandemic, the Boston & Cambridge lodging market was one of the most heavily hit markets in the country. As part of the state’s phased reopening process, hotels were allowed to reopen in June, however, it became clear that most hotels would take a more cautious approach to restarting operations. As of the first week of July some hotels have remained closed, others have opened with limited inventory, while others may face permanent closure. Additionally, the pipeline of proposed hotels for Boston and Cambridge has been disrupted due to construction delays, an eight-week moratorium on all construction in Boston and ten-week moratorium in Cambridge, lack of financing, and general uncertainty. COVID-19, the disease caused by the new coronavirus, has not only negatively impacted lodging demand for years to come but it has dramatically changed the local market’s rooms supply.

As the number of cases increased locally in early to mid-March, government officials declared a state of emergency, restricting travel and large gatherings. Many hotels in Boston and Cambridge began operating at single digit occupancies, forcing owners to close their hotels and layoff, furlough, or reduce hours of their workforce. The hotels which remained open during these months, many of which are in close proximity to the city’s major hospitals, remained open to accommodate patients, first responders, and other contract demand.

As of March 1, 2020, the Boston & Cambridge lodging market was made up of 114 hotels with over 25,900 rooms. Based on information provided to Pinnacle Advisory Group from individual hotel owners and operators as well as the Greater Boston Convention & Visitors Bureau, we know that many hotels closed the last week of March. As a result of these closures, we have estimated that available rooms supply in March was reduced by approximately 15% of its actual amount. In April, 65% of the market’s rooms were offline and in May the number of closed rooms increased further to above 75%. Although hotels were permitted to reopen June 8th, only a select few hotels reopened in the month, increasing the market’s supply to only 30% of its actual size. Operators are optimistic that pent up leisure demand and the market’s ability to capture the regional travelers from the northeast will help to increase lodging demand in the summer and fall months. For this reason, a considerable number of hotels have plans to reopen in July and August. Based on the planned reopening dates provided to Pinnacle Advisory Group, approximately 60% of the market’s rooms supply will be open in July and will then increase to approximately 85% in August. Outside of the properties which may be closed permanently, we expect most hotels to be open by September however we understand that there is a considerable amount of uncertainty in today’s market as it relates to the spread and threat of COVID-19 and reopening plans will likely change.

click on image to enlarge:

Source: Pinnacle Advisory Group, Greater Boston Convention & Visitors Bureau

Estimated openings as of July 3, 2020, subject to change.

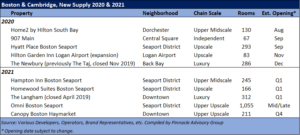

Pinnacle Advisory Group reported on the new hotels opening in 2020 and 2021 in January of this year and had forecasted rooms supply in Boston & Cambridge to increase 3.8% in 2020, well above its long-term average annual growth rate of 2.4%. Six hotels with almost 1,000 new rooms were expected to open throughout 2020. Additionally, there was a considerable number of rooms which came online in Q3 and Q4 of 2019 and both The Langham and The Taj (now The Newbury) were expected to reopen in the second half of 2020. The forecasted increase to the market’s rooms was to represent the second year in a row with supply growth of over 3% and the second highest increase in rooms supply since The Great Recession in 2008/2009.

Based on conversations with hotel developers, brands, and operators with projects underway in Boston and Cambridge, the hotels which were under construction in March of 2020 will be delayed to varying degrees. Those which were in the final stages of construction and near completion are expected to be delayed two to four months. Hotel projects that were in earlier stages with openings later next year could face longer delays depending on the size of the project. When accounting for the delayed openings and the temporary closures that began in March, rooms supply is now expected to increase 1.8% in 2020.

The new hotels entering the market in 2020 and 2021 are outlined below. There are hotels under construction with opening dates in 2022, such as the 147-room Raffles Boston Back Bay, and others which are in early and late planning stages and likely to open in two to four years.

click on image to enlarge:

Owners and operators in the Boston & Cambridge lodging market enjoyed considerable growth in revenue over the last ten years, however that growth began to slow in 2017 as market fundamentals began to shift. The impact from the ongoing pandemic hit the market in mid to late March and has since devastated its performance and disrupted its supply. As owners and operators prepare for changes to their day-to-day operations, many of which will increase operating costs, we do not believe that market fundamentals, a combination of demand and room rates, are unlikely to return to previous levels for three to five years.

Rachel Roginsky, ISHC is the Founder and Principal of Pinnacle Advisory Group. She is based in the firm’s Boston office. Ms. Roginsky has more than 35 years of experience in hospitality consulting.

Sebastian J. Colella is a Vice President with Pinnacle Advisory Group based in the Boston office. Sebastian has over 15 years of experience in the hospitality industry.