Lack of Clear Travel Guidelines Leaves New England Lodging Market in Limbo – by By Rachel Roginsky, ISHC and Sebastian Colella

Hotels throughout New England are normally preparing for their peak season this time of year. Unfortunately, 2020 has been anything but normal. The impact of COVID-19 and the changes to normal day-to-day life have had severe impacts on lodging markets across the country. Many hotels throughout New England have temporarily closed and those that are open are limited to accommodating healthcare workers, other essential workers, the homeless, and those who are self-quarantining. As states roll out phased reopening plans, many hotel owners and operators in New England are now wondering what to expect for their summer and fall seasons, typically their busiest time of the year.

In 2019 the U.S. lodging market experienced a 2.0% increase in demand, accommodating an historic high number of roomnights, and achieving RevPAR (revenue per available room) of $85.96, its highest in history. While the year was off to a great start with RevPAR increasing 4.4% and 3.8% in January and February, respectively, the impact from coronavirus began to take its toll in March. Demand declined over 40% driving RevPAR down 52% when compared to the same time last year. The market segment that declined first, and with such magnitude, was the group segment. As such, many luxury and upper upscale hotels, the full-service hotels which rely on this segment most, experienced declines in occupancy. Since group demand is booked years in advance and typically at lower rates, average daily rates (ADR) was not as impacted in the short-term. As transient demand, normally the higher rated segment, began to decline, occupancy declined at a rapid pace, negatively impacting both occupancy and ADR as can be seen in the April data. Further, given the global nature of the pandemic, travel was being restricted from international destinations, which caused additional downward pressure to gateway market’s which have historically relied more on this demographic.

The tourism industry is a significant economic driver in each of the New England states, supporting hundreds of thousands of jobs and generating billions of dollars annually in each. New England’s peak season, running from June to October, is fueled by leisure and group travel with occupancies above 70% each month. In 2019, these five months made up almost 60% of the year’s total room revenue. The majority of visitors in the summer and fall months are motorists from the northeast US and Canada, typically comprised of couples and families. Group related travel during these peak months include tour groups, and regional corporations or associations that have meetings, as well as social groups attracted to the region’s beautiful settings.

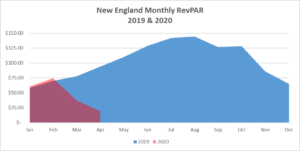

Similar to the trends in the US, the New England regional lodging market has been impacted by Covid 19. As can be seen in the following table, the declines in occupancy and ADR experienced throughout New England in March when compared to last year resulted in a revenue per available room (RevPAR) declined of over 52%.

click on image to enlarge: Source STR

Although April figures for New England are not yet available, RevPAR is expected to decline between 75% and 85%. Preliminary results for the U.S. indicate a decline in RevPAR of approximately 80% in the month of April when compared to the same time last year.

click on image to enlarge: Source STR (historic performance), Pinnacle Advisory Group (projected April 2020 performance)

Although a recovery is likely to be slow and achieving 2019 performance levels could take years, destinations in the New England region could begin to see a pick-up in demand later this summer, potentially more so than other areas of the country. As states begin to loosen their travel restrictions many people will want to venture out after isolating for months. This pent-up demand will likely be focused on regional, drive-to destinations such as those throughout New England. Additionally, outdoor areas and attractions where visitors can distance themselves from others such as national parks and beaches will give visitors a sense of added comfort. Although unemployment is at its highest levels since the Great Depression, heavily discounted nightly rates and low gas prices will further encourage leisure travelers to plan vacations.

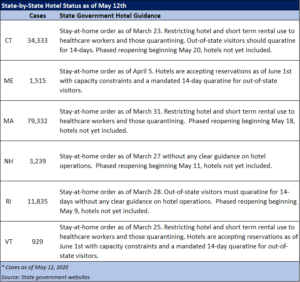

While this bodes well for New England tourism, lodging demand will not return without an easing of social distancing and travel restrictions combined with improved consumer confidence. State governments are facing difficult decisions to reopen businesses in order to lessen the economic toll of the coronavirus while also trying to limit health risks to their residents and visitors. Even as stay-at-home orders are lifted in some states, it is unclear how much longer COVID-19 cases will continue to rise or how successful the government’s response will be in mitigating its impact to individuals and the economy. Making things more confusing for both business owners and consumers are the different guidelines and mandates to commercial lodging businesses across all six states.

click on image to enlarge:

Owners and operators have endured massive losses since mid-March and are growing frustrated without clear guidance on when they can begin accepting reservations for out-of-state travelers without a mandated quarantine. Owners of seasonal hotels which open for four or five months a year are at risk of defaulting on their mortgages and could face bankruptcy. Although the year as a whole will not compare to the performance in 2019, operators are hopeful that bringing back leisure travel July through October will help mitigate the damage.

The leisure demand segment is expected to rebound first providing travel is allowed to return this summer or fall. But for that to happen consumers must feel a level of safety and they will need the financial means to do so. The manner in which each state reopens and welcomes out-of-state travelers will have a direct impact to the wellbeing of the regional lodging market.

About our Authors:

Rachel Roginsky, ISHC is the Founder and Principal of Pinnacle Advisory Group. She is based in the firm’s Boston office. Ms. Roginsky has more than 35 years of experience in hospitality consulting.

Sebastian J. Colella is a Vice President with Pinnacle Advisory Group based in the Boston office. Sebastian has over 15 years of experience in the hospitality industry.