Lodging Recovery in Boston & Cambridge Driven by Leisure Demand as Market Faces Increases to Supply – by Sebastian Colella

As the United States faces a growing number of COVID-19 cases, surpassing 10 million in early November, lodging markets across the country continue to face unprecedented declines in demand. Through October, the Boston & Cambridge lodging market has experienced some of the steepest declines in demand and revenue across the country’s top-25 markets according to STR. Now operating in the winter season, historically the slowest demand period for the Boston & Cambridge market, increasing case numbers have resulted in further restrictions to travel, gatherings, and businesses which were eased over the summer months. The pandemic’s impact to demand continues to reshape the room supply in the Boston & Cambridge market and while there have been improvements to demand levels since the spring, the road to recovery will be long.

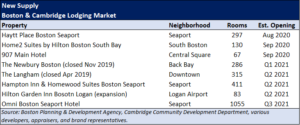

The majority of hotels in Boston and Cambridge temporarily closed in March or April, with an estimated 80% of the rooms supply closed in May. Although most hotels have since reopened, ten hotels remain closed representing approximately 12% of the market’s room supply, including the market’s largest hotel, the 1,220-room Sheraton Boston. Additionally, approximately 5% of rooms supply has been contracted to local colleges and universities for use as student housing. Based on conversations with multiple hotel operators, a number of hotels will temporarily close again with tentative reopenings planned for the spring, while others have already reduced operations to weekend nights only. These reductions to supply are occurring concurrently with new additions; three new hotels opened in 2020 combined for approximately 500 rooms, a 1.5% increase to market supply.

click on image below to view:

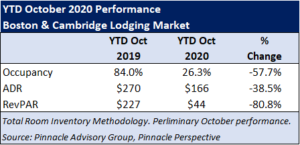

Through October, the Boston & Cambridge lodging market’s demand, or occupied roomnights, has declined over 68% when compared to the same time last year. Although the market was experiencing demand declines of over 90% between April and June, these declines have improved during the summer and fall months. As a result, the market occupancy is slightly over 26% through October, a considerable decline from the 84% occupancy achieved last year through October. Relying primarily on lower rated leisure and contract demand, the market’s average daily rate (ADR) has declined 38.5% during the period. With a revenue per available room (RevPAR) of $44 through October, owners and operators have generated 80% less room revenue than the prior year.

Historically, lodging demand in the Boston & Cambridge market has been consistently split among corporate transient, group, and leisure, each representing about 30-35% of total demand. Pinnacle Advisory Group’s outlook for each segment is outlined below.

- Given the shift to work remotely this year and very little corporate travel, both domestic and international, there has been a considerable decline in corporate lodging demand in market since March. According to a number of local operators, there was a slight increase in corporate demand in September and October. Despite these minor increases, Pinnacle expects corporate demand levels to begin to diminish in mid-November. We believe that the corporate segment will begin to recover in Q2 2021, with increased growth rates through the second half of the year. Our 2020 and 2021 projections reflect the corporate segment reaching approximately 25% and 50%, respectively, of 2019 levels by yearend.

- One of the most impactful government restrictions to the lodging market has been the guidance on large gatherings. As a result of the orders, the last event held at one of Boston’s convention centers was in March 2020 and there has been very little group and convention demand in the market since. Outside of small SMERF (Social, Military, Education, Religious and Fraternal) groups which are typically low rated, hotels have not had the benefit of hosting groups. We have forecasted this trend to continue through the first half of 2021. The recovery of the group segment will depend largely on when restrictions to travel and large gatherings are eased or lifted, or ultimately when an effective vaccine is widely available. As of November, the city’s two convention centers and many full-service hotels have a significant amount of group demand on the books as early as July 2021. Our 2021 projections reflect the group segment reaching approximately 15% of 2019 levels by yearend and assumes that although attendance may be light events in the second half of 2021 will take place.

- Leisure demand was on the rise through much of the summer and fall months. Made up of mostly regional travelers, this segment is expected to ebb and flow with seasonal swings, holidays and vacation periods, or driven by local demand generators. Our 2021 projections reflect the leisure segment reaching approximately 70% of 2019 levels by year-end. With very little corporate and group demand in the market, leisure rates are expected to be extremely competitive.

As market demand begins to recover through much of 2021, the Boston & Cambridge market’s room supply will expand. With five additions to the market in 2021, the number of available rooms is expected to increase 6.7%, its largest increase since 1999. Hotels entering the market in 2020 and 2021 are outlined below.

click on image below to view:

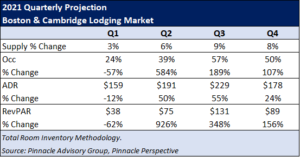

Pinnacle Advisory Group utilizes a Total Rooms Inventory (TRI) methodology which assumes all hotel rooms are available and operational, including rooms which are temporarily closed or being used as student housing. Pinnacle Advisory Group has projected demand in the Boston & Cambridge lodging market to decline 68% in 2020, equating to a 26% market occupancy. ADR is expected to decline 38%, resulting in a decline in RevPAR of over 80% when compared to last year. As outlined previously, demand is projected to improve through 2021 achieving an occupancy of 43%. Although the market’s ADR recovery is expected to take longer than occupancy, Pinnacle has projected ADR to increase 20% in 2021, the majority of which will be realized in Q2 and Q3.

click on image below to view:

Quarterly projections for 2021 are outlined below.

While reported progress in vaccine development is welcome news, especially to industries which rely on travel and leisure, there remain numerous unknowns as to when and how the global economy will return. As a destination and as an economy, the Greater Boston area is built around education, healthcare, high-tech research, and financial services all of which are equally stable and strong demand drivers. Matched with a highly skilled workforce, robust tourism and conventions, and the strength of Boston Logan International Airport, the market is well positioned for a recovery once the country begins to emerge from this pandemic and long-term economic stability.

Pinnacle Advisory Group has updated its Boston & Cambridge Outlook originally presented in August 2020. This presentation which outlines market projections and trends for 2020 and 2021, can be found here.