April 15, 2020 4:47 pm

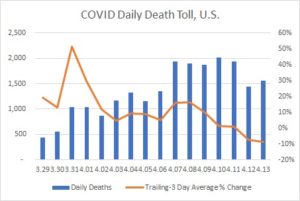

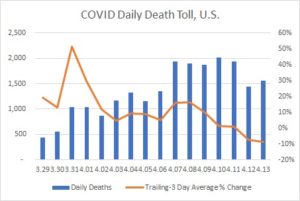

Comments Off on The Curve Has Flattened; What Does the “Interim Normal” mean for Hotel Operations? – by Karen Johnson, ISHC, MAI, CRE Though the arc of people with confirmed cases of Covid-19 is going up as more individuals are tested, the curve of the average daily death toll appears to have flattened. Which indicates that the act of social distancing will keep our ICU capacity from being overwhelmed as it was in Hunan and Italy. We can only hope.

click on image below to enlarge:

Source: Johns Hopkins University, as reported in the Wall Street Journal and the LA times

Assuming the US can get enough testing capacity to determine the true infection and mortality percentages, and plans are devised to move equipment where it is needed, things could get back to the “new normal” or at least an “interim normal” fairly soon.

There is much speculation as to when we will re-open the economy as well as on possible second waves, as happened in Toronto after the first SARs outbreak. Until a vaccine is found, infection rates will likely increase when lockdowns are rolled back. Countries about to lift lockdown restrictions are staging re-openings that put hotels and then conventions/meetings at the very end of the list. Most hotel owners cannot afford to wait.

The US hotel industry has offered to house first responders, provide additional beds for non-critical, non-communicable patients, recovering Covid-patients, and even the homeless. Thankfully, very little assistance has been required in those areas.

How do hotels create opportunities aligned with keeping society safe while still reviving our businesses?

What if US hotels focused on quarantine-safe re-integration efforts? Some households have both vulnerable and non-vulnerable members. What if hotels offered a low-cost or government-subsidized “safe haven” extended stay lodging in which vulnerable cohorts were only admitted after testing negative? For those too frail to leave home but with family members that need to be out in the world, other hotels could offer transient lodging with “in-and-out privileges” to spare that cohort the fear of bringing the virus home. Yes, families would be split, and visiting would happen across plexiglass shields. Not ideal, but neither is destroying families thru economic ruin. Now is the time for hotels to plan for the “interim normal” while social distancing is here to stay.

April 7, 2020 7:05 pm

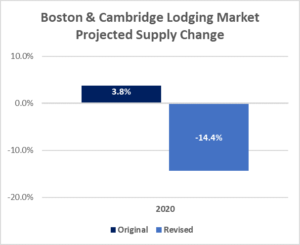

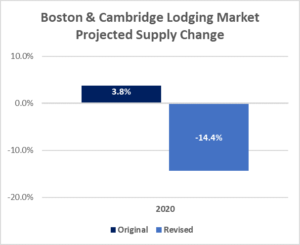

Comments Off on Boston & Cambridge Lodging Market: COVID-19 and its Impact on Supply – by Sebastian Colella Pinnacle has revised projections for 2020 supply change in the Boston & Cambridge lodging market from +3.8% to now -14.4%.

Life across the United States has changed dramatically in the last four weeks. In Boston, and almost every other city in the country, hotel owners and operators have been forced to make the difficult decision to close temporarily while the country attempts to slow and contain the spread of COVID-19. In Massachusetts those decisions were partially made for them on March 31st.

Governor Baker extended his order closing non-essential businesses in Massachusetts through May 4th. This extension included changes to operating guidelines for hotels, motels and short-term rentals which can now be used for limited purposes only; housing front-line workers fighting the coronavirus, essential workers, or residents displaced from their homes. A number of the hotels in the market, primarily those in close proximity to the city’s major hospitals, have remained open to accommodate patients and first responders. The vast majority of hotels in Boston and Cambridge, however, have closed or are in the process of closing.

History tells us that many of the hotel projects that are in planning will be delayed or may not come to fruition. For example, following the 2008/2009 recession, many hotel construction projects were stalled while others were unable to attain the financing needed to begin. Supply increased in 2009 and 2010 as projects had already begun prior to September 2008 however, there was very little growth in supply 2011 and 2012. For the four years between 2011 and 2014, approximately 300 new rooms were added to the Boston & Cambridge lodging market. In the last five years, between 2015 and 2019, the market added over 3,200 new rooms. As reported by Pinnacle previously, the surge in supply has had a mitigating effect on the market’s occupancy and rate in recent years.

click on image below to enlarge: Source: STR, Pinnacle Advisory Group

As of March 31st, the Boston Planning and Development Agency and the Cambridge Community Development Department had a pipeline made up of over 8,000 proposed hotel rooms, of which 31% are listed as under construction and over 40% are approved. Based on this construction pipeline and our familiarity with each project, Pinnacle had projected hotel supply in Boston & Cambridge to increase 3.8% in 2020. Six hotels with almost 1,000 new rooms were scheduled to open in 2020, along with the considerable number of rooms coming online from Q3 and Q4 of 2019. When including the reopening of both The Taj (reopening as The Newbury) and the Langham Hotel, the market was expected to experience its third consecutive year with above average supply growth.

Given the dramatic changes to travel that are currently taking place, the Boston & Cambridge lodging market, like many throughout the country, will experience changes not just to demand and average daily rate but its rooms supply as well. There is still much to be learned about the coronavirus pandemic and its long-term impact on the global economy. Epidemiology experts have varying opinions on the ‘best-case’ scenario however some have indicated that the country may see a retraction in the number of COVID-19 cases in the summer which would allow for a lifting or easing of travel and meeting restrictions. Under the assumption that this takes place in mid to late June, Pinnacle has revised projections for supply change in the Boston & Cambridge lodging market to decline 14.4%.

click on image below to enlarge: Assumes a retraction in the number of COVID-19 cases and a lifting of travel and meeting restrictions in mid to late June.

Source: Pinnacle Advisory Group

Supply is estimated to have declined between 15% and 20% in March with declines expected to deepen further in April reaching 80% to 90%. Most hotels which have closed have loose plans to reopen mid to late May, but even then, we do not expect that they will be operating with a full inventory of rooms. We have projected supply to return close to prior levels by August, however, we have already been notified of some hotels not reopening in 2020 but instead focusing on renovation and repositioning efforts.

Prior to the ongoing COVID-19 crises, the Boston/Cambridge market was expected to see supply increase 6.6% in 2021, the largest annual increase in rooms supply in over 20 years. A large portion of this increase in rooms was to be driven by the 1,055-room Omni Boston Seaport, the market’s largest hotel to open since the Marriott Copley Place opened in 1984. Given the declines in supply resulting from temporary closures in Q1 and Q2 2020, the supply increases expected in 2021 will be substantially greater, although somewhat artificially inflated due to the unprecedented number of temporary hotel closings.

As was the case following the financial crisis in 2008, there is expected to be limited lender interest and equity dedicated to new hotel projects as the economy faces declines. As such, hotel projects which are currently in the planning process will be delayed as financial parties wait to see how the economy responds to the COVD-19 crises and economic downturn. Following a considerable increase in supply in 2021, we expect supply increases to diminish between 2022 and 2023.