Author Archives: Amanda Wiggins

September 13, 2023 2:05 pm

Comments Off on Rhode Island Lodging Market Outlook – by Rachel Roginsky, ISHC On September 13, 2023, Rachel Roginsky, ISHC, presented at the Rhode Island Hospitality Association’s Economic Outlook Breakfast. The lodging presentation included a discussion and analysis of the national lodging market, the Rhode Island lodging market, and data on four submarkets in the state: Providence, Warwick, Newport, and Middletown.

Rachel provided information on the health of the economy, the Rhode Island Convention Center, TF Green Airport, the local office markets, and other factors that influence lodging in the state. For each submarket, Rachel prepared projections for 2023 and 2024. In Rachel’s speech, she noted that each of the 4 submarkets in Rhode Island operated very differently from each other, with different demand generators and operating performance metrics. One key takeaway for all submarkets was that room rates were decelerating and that the corporate market was gaining but at a much slower pace than the regional and national lodging market. However, the forecast for next year is still in positive territory.

Click on the link below to view or download the presentation:

RI Outlook Presentation 2024

August 11, 2023 4:41 pm

Comments Off on Hotel Market Set to Surpass Pre-Covid Performance – Banker & Tradesman, by Rachel Roginsky, ISHC After Lagging U.S. Markets, Boston Rebounds in 2023

Just 12 months ago the Boston and Cambridge lodging market was showing signs of a recovery from the pandemic, but we’re slower to recover than most markets across the country. It’s quite a different story today the city’s lodging market has not fully recovered from the devastating impact of the global pandemic that began in early 2020 however, hotel managers in the local lodging market are not looking back anymore. Without hesitation, it’s fair to say that the local hotel market is only slightly below pre-pandemic levels and room revenues are expected to surpass 2019 by year end 2023.

Please click on the title below to view or download a copy of the article:

Banker and Tradesman – May 2023 edit

August 3, 2023 5:34 pm

Comments Off on Outlook 2024 – Rachel Roginsky, ISHC Outlook 2024 presentation given by Rachel Roginsky, ISHC, for the Mass Lodging Association: Providing insight on general economic and lodging trends, the presentation provided attendees with 2023 and 2024 projections for both the Boston suburbs as well as the Boston & Cambridge lodging markets.

Click on the title below to view or download a copy of her presentation.

Outlook 2024 FINAL 8.3.2023

April 20, 2023 7:01 pm

Comments Off on MeetBoston’s Quarterly: Hotel Operating Performance in Boston/Cambridge – Presented by Rachel Roginsky, ISHC Rachel Roginsky recently presented at MeetBoston’s quarterly meeting for Director of Sales in the Boston market. The meeting agenda included information on upcoming plans for the Boston Convention Centers, sales and marketing updates for the City, and details on the Army Navy football game being held at Gillette Stadium in December 2023. On behalf of Pinnacle Advisory Group, Rachel presented on hotel operating performance in Boston and Cambridge for the first two months of 2023, qualitatively discussed supply and demand, and shared Pinnacle’s 2023 year-end projections.

Click on link below to view the presentation:

Boston Cambridge Lodging Market – April 2023 – FINAL

April 6, 2023 7:17 pm

Comments Off on Boston Chapter of the Lambda Alpha Society (LAI): Boston/Cambridge Lodging Market – Presented by Rachel Roginsky, ISHC Rachel Roginsky recently presented at the Boston chapter of the Lambda Alpha Society (LAI) in April. The members of LAI represent a diverse group of professional disciplines in fields related to the ownership and use of land and buildings. The Society’s original goal of “fostering a closer association with academia and professionals involved with land economics and related fields”, while still valid today, has expanded. The Society is now a catalyst for the advancement of land economics by facilitating the interaction of members who have distinguished themselves in their professions, their communities, and through academic achievements. Rachel was asked to present statistics for both the national and local markets. Her discussion includes quantitative and qualitative information on hotel operational and financial performance, hotel feasibility, factors that will impact the lodging industry, and projections for the hotel industry.

Click on the link below to view the presentation:

Boston Cambridge Lodging Market 2022 – FINAL

February 21, 2023 8:03 pm

Comments Off on Boston & Cambridge Lodging Strengthens in 2022 With More Upside for 2023 – by Rachel Roginsky, ISHC Despite a slow start in the first Quarter 2022, the Boston & Cambridge lodging market ramped up quickly, and by year end, the Revenues Per Available Room (RevPAR) reached a 90% index compared to its 2019 (pre-covid) top line performance. Like many urban gateway cities, the city struggled in its recovery from the negative effects of the pandemic in 2021, as compared to other cities located in warmer climates, which showed strong recoveries one year following the outbreak of Covid in March of 2020. Yet despite the slower recovery, in 2022, leisure demand came roaring back in Boston, while corporate and group travel picked up steam starting in Q2. One of the missing links to a full recovery in Boston was international travel which was subject to federal travel restrictions but has recently begun to open up. Despite sizeable year-over-year increases in occupied roomnights in 2022, the actual occupancy metrics remained behind 2019 due to the substantial increases in lodging supply (available rooms) in 2021 and 2022. However, hotel guests in all segments of demand were paying premium room rates and as a result, the average daily rate (ADR) in Boston exceeded the city’s pre-covid ADR. Given the trajectory of the recovery in 2022, owners and operators are optimistic that favorable trends will continue through 2023. The expectation is that 2023 will feel more like 2019 in terms of overall travel in the Boston market.

2022 Retrospective

The Boston & Cambridge lodging market had an occupancy of 45% in 2021, only 55% of its level in 2019. By yearend 2022, occupancy increased to 69.5%, representing an 84% index to 2019. The market’s ADR has recovered at a faster pace than its occupancy, climbing to $279 in 2022, a 31% increase over 2021 and a 7% premium to 2019 levels. As a result, the market’s revenue per available room (RevPAR) was 90% of its level in 2019. By comparison, the U.S. lodging market’s RevPAR in 2022 was 105% when indexed to 2019. The country’s top-25 markets reached 66.5%, an ADR of $173.35 and a RevPAR of $115.27, according to STR. Through year-end 2022, the top-25 market’s RevPAR was 100% when indexed to 2019.

click on image below to enlarge:

A Late Start

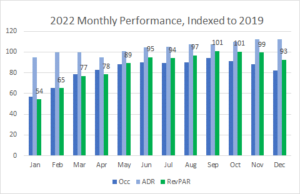

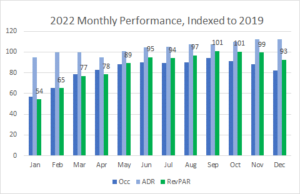

The recovery did not begin to take shape in Boston until late spring of 2021. In January 2021, the RevPAR index (to 2019) was 20%. By December 2021, the RevPAR index climbed to 72%, with a yearend average of 44%. Unfortunately, this upward trend at the end of 2021 took a backward turn due to the onset of the Omicron variant which once again, slowed the recovery in early 2022. Starting in May of 2022, the RevPAR index climbed to 89% of 2019, and hoteliers in the City no longer looked backwards. For the 8-month period between May and December, the RevPAR index averaged 96% to 2019. The table below shows the market’s performance metrics for occupancy, ADR and RevPAR, indexed to 2019 levels as a measure of its recovery to pre-pandemic levels.

click on image below to enlarge:

The Boston market has always been a seasonal market with January, February and December categorized as low season with occupancies in the 60’s. March, April, May, and November represent the shoulder season with occupations in the 80’s. Peak season from June through October typically reaches high 80’s/low 90’s. In 2022 the city operated in this same pattern, but at much lower occupancies than what was experienced pre-covid. For example, in the low period, the monthly occupancies averaged in the low 40’s, and shoulder season averaged in the low 70’s and the peak season averaged in the low 80’s. Room rates are also seasonal in the Boston market. By way of example, in 2019 the ADR in January and October was $170 and $310, respectively. In 2022 the same pattern emerged but with an ADR of $161 in January and $342 in October. AS you can see in the prior table, the monthly ADR in 2022 began to exceed the 2019 ADR. Specifically, from May and for every subsequent month, the ADR index exceeded 100% of the 2019 ADR. Given the substantial improvements in demand, and aggressive room rates, the RevPAR in both September and October exceeded the 2019 RevPAR, was above a 90% index for six additional months in 2022.

New Supply

The market accommodated approximately 7.2 million roomnights in 2022, compared to 7.7 million in 2019. The yearend occupancy in 2022 was estimated to be 70%, a far cry from the 82% occupancy recorded in 2019. As just discussed, the market experienced a very strong recovery in demand in 2022, but one must also consider how quickly the market can absorb new lodging supply. Presented below is a table that outlines the new supply in 2021 and 2022 in Boston and Cambridge. The new supply represented a 9% increase in lodging supply since 2019.

click on the image below to enlarge:

While hypothetical, if you apply the actual occupied rooms in 2022 to the available rooms in 2019, the city’s 2022 occupancy would have been 77%, seven points higher than actual year end 2022 occupancy.

Outlook for 2023

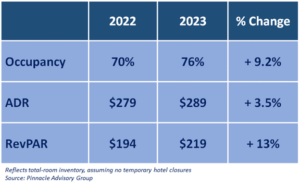

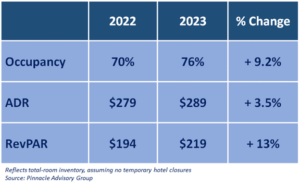

It has been very challenging to prepare a forecast since the start of the pandemic. The impact of the pandemic on the lodging industry has been significant, and the pace of the recovery was, and continues to be unknown. There are still effects from the pandemic with new variants impacting travel. Economists have wide ranging opinions as to when, how long, how strong, and if a 2023 will occur. The war in Ukraine has yet to impact travel in the US, but no one knows how that might change in the future. Work from home – work from office – hybrid work remains uncertain for 2023. With this in mind, Pinnacle believes that demand will improve in Boston and room rates will increase. Our expectations for demand growth, coupled with limited new supply in 2023, along with several properties that are expected to be off-line, results in a projection of 76% for yearend occupancy.

Presented below is our 2023 forecast for the Boston/Cambridge:

click on image to enlarge:

All demand segments will improve in 2023. Business travel gained significant momentum since May of 2022 and it will continue its upward trajectory. Leisure has proven to be resilient and while it may moderate in 2023, Boston has clearly proven itself to be a leisure destination. Small and large groups and conventions are back. Accordingly to Meet Boston, the BCEC will have a record year of room nights in 2023, beating the record set in 2019 of 488,000 roomnights. Most international travel restrictions have been lifted. Colleges have re-opened and the events that are generated from these institutions are out in force. With demand back, hotel managers will continue to drive rate, even if rate growth is closer to inflationary levels and that was experienced in 2022.

There is much to be optimistic about as we move into 2023 although the hospitality industry has become accustomed to surprises. In addition to continued uncertainty with demand and pricing, hotel owners and operators have managed both a challenging labor market and supply chain issues which have created wage pressures and increased operating costs. Nevertheless, all signs point for a healthier lodging market in 2023.

January 20, 2023 9:07 pm

Comments Off on LOOKING UP AGAIN – Three years after the start of the pandemic, Boston-area hotels are optimistic again – Rachel Roginsky, ISHC, featured in the Boston Business Journal Boston-area hotel leaders are finally seeing room for optimism.

Boston Harbor Hotel General Manager Stephen Johnston. As we approach three years since the pandemic began, hotel occupancy rates continue to slowly come back. Relatively big progress was made in 2022, hotel managers said, and they’re optimistic about the new year. Signs mandating mask-wearing are few and far between. Those ubiquitous hand-sanitizer stations are largely gone, as are the floor stickers showing people how and where to stand six feet apart.

Nearly three years into the Covid pandemic, Boston-area hotels are starting to feel normal, and what’s more, they’re finally approaching pre-pandemic occupancy levels. Boston-area general managers say they’ve adjusted to the continuing slow pace of business and international travel, and have even found reasons to look forward to the new year.

“I’m going into 2023 quite optimistic,” said Stephen Johnston, GM of the Boston Harbor Hotel.

The numbers support his optimism: Pinnacle Advisory Group projects Boston and Cambridge hotels to hit 93% of 2019’s occupancy rates, and to exceed 2019’s numbers in two other categories: average nightly room rates, and revenue per available room, or RevPAR.

Pinnacle projects that Boston and Cambridge hotels will hit 76% occupancy this year, up from 70% in 2022 and from just 45% in 2021. Those numbers are good enough for Rachel J. Roginsky, principal and owner of Boston-based Pinnacle. “If we can get back to 76%, that would be fantastic,” said Roginsky. “We’ll still be lacking the corporate demand. It’s still not back yet, but I see it getting better. We’re not yet at 100%. We’re not anywhere near where we were pre-Covid.”

Catching up

Boston isn’t the only major market struggling to regain its pre- pandemic hospitality numbers, but it’s lagging most of the country’s other biggest markets. The Boston area’s year-over-year performance was worse last year than the median of the 10 largest metro areas in occupancy rates, average daily room rates and revenue per available room, according to an analysis of data from hospitality data and analytics company STR.

Experts say that’s attributable to a few factors. Boston is less of a vacation destination than New York, Los Angeles or Miami, leaving it more reliant on business travelers. It’s also seen would-be travelers choosing regions with looser attitudes toward pandemic precautions, such as Dallas or Houston, Roginsky said.

Boston-area hospitality leaders said they have reasons to be bullish on 2023, however. The region has made big leaps in key measurements since May 2022, when activity resumed following the Omicron surge. They’ve seen an encouraging number of bookings for business travelers, weddings and other segments.

And while occupancy rates are still lagging, hidden in that data is the 10% growth in rooms that have opened in Boston and Cambridge since the pandemic began. That includes more than 2,000 rooms at four properties that debuted or reopened in 2021: the Omni Boston Hotel at the Seaport, The Langham, The Newbury and the Hampton Inn/Homewood Suites in the Seaport. “You see numbers that rival what they were before the pandemic,” said Dave O’Donnell, the vice president of strategic communications for Meet Boston, formerly known as the Greater Boston Convention & Visitors Bureau. O’Donnell credited a renewed belief that in-person meetings and events are needed. Meet Boston is working to market the region as a good place to hold such gatherings. “We’re saying, ‘There’s no place like Boston to hold your meeting,’” O’Donnell said.

Marianna Accomando, the general manager of the Seaport Hotel, agreed that “people want to meet in person, especially those businesses that have had remote teams in place.” “There’s a strong desire for connection and bringing those individuals to the same place to engage with each other,” said Accomando. Hotels are also charging room rates that back up their confidence. An average nightly rate of $227, as measured by Cheaphotels.com this past fall, makes Boston the most expensive city in the country to get a room.

‘Bleisure’ is booming

Hotel managers pointed to last May as a key point in the recovery. That’s when many businesses started booking travel again, and people started booking leisure stays. Starting that month, hotel occupancy and nightly room rates were virtually in line with 2019. Another factor has been trips combining business and leisure, for which the awkward-sounding term “bleisure” arose. It’s been an unexpected boon for hotels, tacking on an extra night or two before or after a business trip. “We never used to see that on the scale we see now,” Johnston, the Boston Harbor Hotel manager, said of such trips.

Yotel, which opened in the Seaport in 2017, expects to benefit from the return of business travel, especially with more events expected this year and next at the nearby Boston Convention and Exhibition Center. “We feel confident that business is back,” said Julia Greenwald, Yotel’s sales and marketing director.

XV Beacon, a high-end Beacon Hill hotel, is still seeing a lag in international travel but is busier with corporate travel now, general manager Amy Finsilver said. “We’re much more hopeful than we were a year ago,” she said. In another sign of optimism, one of XV Beacon’s sibling restaurants, Mooo, has opened two new locations, in the Seaport and Burlington. “We foresee it being a much stronger year,” Finsilver said.

Trading masks for new markets

Hotels are also shifting where they’re looking for potential guests. The Boston Harbor Hotel, for example, is no longer advertising in Asian markets, which was popular for families visiting local college students before the pandemic. Instead, it’s marketing in the United Kingdom and Ireland, where bookings are strong despite weak exchange rates.

Some hotels have seen record numbers of weddings, which they said helped save their year. That was the case for Boston Harbor Hotel and Beauport Hotel in Gloucester, whose harborfront site has beat its pre-pandemic occupancy numbers. “We just finished our best year ever for the Beauport Hotel,” said Ray Johnston, the managing director of the Beauport Hospitality Group. The Gloucester hotel exceeded expectations for the year in large part due to a surge in the number of weddings. Beauport hosted weddings even on Thursdays and Sundays — and it’s begun booking Thursday weddings again this year, Johnston said.

Perhaps most visibly, hotels no longer sport the physical markers of the early-pandemic days. Plexiglas at front desks and signs advising mask-wearing have largely been removed. Far fewer guests ask about — or show concern about — safety precautions, even as hotel managers say they’ve kept as vigilant about cleaning as they have for two years. XV Beacon, for example, still uses a type of ultraviolet disinfectant called UVC light for 45 minutes between guest stays, and it seals doors with a sticker to show guests that rooms haven’t been entered.

It’s now a different type of unknown that makes the industry unsure of what to expect: a potential economic downturn. “Even a mild recession is still a recession, and travel does get cut,” said Roginsky, whose 2023 forecast factors in a slight economic dip. “I’ve been projecting for 30 years, and we’re usually off by just about a point. This could be off by 5 points. We just don’t know.”

December 18, 2022 9:26 pm

Comments Off on No Room for Discounts as Hotels Recover – Rachel Roginsky, ISHC featured in Banker and Tradesman Global Investors Rank Boston as Top 3 Market

By Steve Adams | Banker & Tradesman Staff

The new owners of the former Loews Boston hotel are targeting “bleisure” travelers who combine business trips with sightseeing after acquiring the property for $117 million in August and announcing $20 million in upgrades.

Shuttered hotels and skeleton-crew staffs are fading into distant memory as the Boston lodging market approaches a full financial recovery from the depths of their pandemic plunge. In contrast to previous economic downturns, hotel owners largely have resisted slashing room rates to boost occupancy. And travelers are willing to pay, with average room rates in Boston and Cambridge surpassing pre-COVID levels this year. “Looking at past recessions, you cut rates to increase occupancy. That didn’t happen this time,” said Rachel Roginsky, principal and owner of consultants Pinnacle Advisory Group. “This is the first time in 30 years that I can recall average daily rates driving the recovery.” Industry executives say pent-up demand and a roaring return of tourism business gave hotel owners the leverage to hold firm. Through October, average room rates were $287 at Boston and Cambridge hotels in 2022, with an occupancy rate of 71 percent.

Global Magnet for Investment

A recent survey by JLL ranked Greater Boston’s approximately 63,000-room hotel market as one of the top three targets of investors globally, trailing only London and Tokyo. The hotel investor sentiment survey cited Boston’s strong recovery burgeoning life science industry and rebounding leisure market. The opening of the Raffles Boston Back Bay Hotel & Residences next spring will elevate high-end rates in the city, JLL predicts. Occupancy rates are already in striking distance of pre-pandemic levels in the core Boston market, following a steady recovery that started in the spring driven by the leisure market. In October, the most recent month for which data is available, Boston and Cambridge hotel occupancy rates were just 2 percent below 2019 levels, according to Pinnacle Advisory Group.

Average daily rates have topped 2019 levels in every month since May. And revenues per available room – a key measure of a hotel’s performance that blends occupancy levels with room rates – surpassed 2019 levels for the first time in September and October, according to Pinnacle research. “Coming out of the pandemic, the leisure travelers were certainly driving the momentum here,” said Alan Suzuki, a managing director in capital markets for JLL Boston. “Even in this inflationary environment, people wanted to travel, there was pent-up demand and international borders were starting to open up. People were just paying the rates.” Uncertainty still clouds the outlook for winter and early spring, and future demand for business and convention-driven group bookings.

Developers Wait for Costs to Cool

Several developers moved forward with downtown Boston hotel proposals as the pandemic eased, but are waiting for potentially more favorable construction and financing climates in 2023 to break ground. After gaining approval for a 31-room hotel at 88 North Washington St. in the West End last year, developer Boston Real Estate Collaborative is waiting out the inflation cost and interest rate climate. Managing Partner Brent Berc expects more competitive bidding to emerge among building contractors in 2024. “We are starting to get calls from people trying to line up jobs, and that hasn’t happened for 12 to 18 months,” Berc said.

Allston-based City Realty also is taking a wait-and-see approach to the timeline for its 80-room hotel approved last month on Hamilton Place in Downtown Crossing. Director of Acquisitions Clifford Kensington said the company is evaluating a variety of building types including steel, concrete and mass timber amid a volatile cost environment. The firm is in the early stages of raising equity, targeting approximately a 60-to-40 loan-to-cost ratio. Kensington estimated a financing agreement and groundbreaking could take place in fall 2023.

A 134-room hotel at 42 Cross St. in North End remains delayed by a lawsuit filed by a neighbor, developer William Caulder confirmed. Developers looking for financing to build new hotels still face a hostile climate because of interest rate hikes and construction costs that have risen up to 30 percent, according to JLL research. “There’s still risk factors out there and also construction costs are up, so the numbers don’t pencil,” Suzuki said.

While hotel investment sales activity has been sluggish, some investors have seen opportunities to upgrade existing properties. In Boston’s largest deal of the year, AKA and Electra America paid $117 million for the Loews Boston hotel in August. The joint venture rebranded the 225-room Berkeley Street property as Hotel AKA Back Bay and plans to invest $20 million on guest room renovations, new common-area amenities and updates to Precinct Kitchen + Bar. The JLL report indicates that hotel investors across the globe are opting for upgrades to existing properties over new construction in the short term. “Development is not impossible today, but it’s challenging,” Suzuki said. “And that’s good for the industry. [Existing hotels’] performance is starting to improve from an operating perspective, and it gives them the runway to get back to where they were pre-pandemic.”

November 28, 2022 6:12 pm

Comments Off on Boston & Cambridge Lodging Market – Q4 2022 UPDATE, Presented by Sebastian Colella This presentation is our Q4 update and projections for the Boston & Cambridge lodging market. The presentation is an update to the MLA’s annual Outlook event which was held in August and features Pinnacle Advisory Group, along with the Massachusetts Convention Center Authority, and The Greater Boston Convention and Visitors Bureau, among others.

Click on the link below to view and download the presentation:

Outlook 2023, Q4 Update – 11.28.22

September 15, 2022 12:25 pm

Comments Off on Navigating RFP Season and Resetting Hotel Partnerships – by Sebastian Colella In September, Sebastian Colella participated in the Global Business Travel Association’s (GBTA) New England Chapter meeting titled “Navigating RFP Season and Resetting Hotel Partnerships.” Sebastian presented Pinnacle’s Outlook for the national lodging market as well as the Boston Suburbs and Boston and Cambridge lodging markets. The forecasts provided a segue into the event’s thought-provoking conversation addressing best practices to consider from both the buyer and supplier side of negotiating preferred hotel programs and the post-pandemic approach to groups and meetings. The GBTA’s New England Chapter supports corporate travel managers and provides the tools, information, and networks required for effective business travel management.

Click on the link below to view the presentation:

Final – NEBTA Outlook 2023