Author Archives: Patricia Grant

February 24, 2025 3:39 pm

Comments Off on Boston/Cambridge Lodging Market – 2024 Year-End Review & 2025 Outlook – By Rachel Roginsky, ISHC The Boston and Cambridge (“City”) lodging market, both pre- and post-COVID, remains one of the most vibrant and dynamic in the United States. As of year-end 2024, according to STR, the Boston MSA ranked 5th highest in occupancy and 3rd highest in ADR among the top 25 markets. Only two top 25 markets, New York and Oahu Island (HI), exceeded Boston’s year-end RevPAR. Unfortunately, the Boston/Cambridge market is currently performing below pre-COVID levels when the City consistently achieved occupancy rates in the low 80s. While ADR remains strong, it has not kept pace on an inflation-adjusted basis. For 2025, we expect the local lodging market to see continued positive results, albeit at a measured pace. This article examines the current state of the Boston/Cambridge market and offers short-term projections for the future.

Dissecting 2024 Top Line Performance

The Boston/Cambridge lodging market ended 2024 with an occupancy rate of 77.2%, reflecting a 1.2% increase over 2023’s 76.3%. This small increase in occupancy is a result of the market accommodating 1.5% more rooms in 2024 compared to the prior year; 2.3% more rooms occupied as compared to 2019. Seasonality patterns aligned with typical expectations, with peak season (April through October) occupancy ranging from 81% to 88%, averaging 85%. The shoulder months (March and November) averaged 75%, while the slow season (January, February, and December) averaged only 61%.

In terms of market demand mix, based on data from hotel managers in the City, the 2024 distribution was: group (26%), contract (4%), transient leisure (42%), and transient corporate (28%). This compares to an estimated 2023 mix of 22%, 6%, 45%, and 27%, respectively. Both group demand and corporate transient demand increased, continuing to rebound from the pandemic’s impact.

Overall, ADR increased by 3.1% in 2024 over 2023, though monthly growth was inconsistent. For instance, in January, March, June, and December, ADR increased by less than 2%, while November saw a nearly 3% decline. In contrast, the remaining 7 months experienced ADR increases ranging from 3.5% to 7.1%. Business and group travelers contributed more to rate growth, generally paying above inflationary increases, whereas leisure travelers remained more price sensitive. The City also experienced stronger increases as a result of compression for citywide events.

With both strong occupancy and room rates during peak season, the Boston/Cambridge RevPAR reached $232.62 in 2024, up 4.3% from 2023. Local hotel operators and owners should be pleased with these results; however, concerns remain as the pace of growth has begun to slow.

Click on image below to enlarge:

While 2024’s overall occupancy and ADR figures were strong, performance varied across submarkets. The Logan Airport submarket achieved the highest occupancy (83.4%) but at the expense of ADR, resulting in the second-lowest RevPAR in the City at $189. The Fenway/Longwood Medical Area and North End/West End followed, both with approximately 81% occupancy. Conversely, Cambridge had the lowest annual occupancy at 74%, a notable decline from its pre-COVID performance (2019: Cambridge 81.7% vs. Total Boston/Cambridge 82.5%). Factors contributing to Cambridge’s weaker performance include decreased demand from tech companies, the shift to remote/hybrid work, and a softening life sciences sector.

From a rate tier perspective, luxury hotels faced ongoing challenges, with 2024 occupancy at just 60%. This segment continues to struggle primarily due to a 35% increase in luxury room supply since 2019, coupled with the larger gap in pricing between the upper upscale hotels and the luxury tier. However, the luxury ADR grew 2.3% to $612, with RevPAR increasing 6% to $364. The upper-upscale tier also saw strong RevPAR growth, rising 6% to $268, aligning with national trends where higher-end hotels outperformed the overall market.

2025 Projections: A Steady, Balanced Market

Nationally, the lodging market in 2025 is expected to see muted growth, with stable occupancy levels and moderate ADR increases, leading to projected RevPAR growth of approximately 1.8%, according to STR. Most of this growth will stem from ADR rather than occupancy gains. Economic conditions, inflation, and interest rates will influence consumer spending, while the new administration’s policies could introduce further uncertainty.

For Boston/Cambridge, projections indicate similar trends but with a more robust outlook compared to the national market. Demand will continue growing, albeit modestly, though occupancy is unlikely to return to pre-pandemic levels of 81%-82%. Key factors shaping the 2025 outlook include:

- Minimal New Supply: The only significant addition is the Cambria Hotel, opening mid-2025, alongside partial-year impacts from the late-2024 CitizenM opening and a few renovated rooms returning to inventory, representing a 1.3% supply increase.

- Convention Business Growth: Signature Boston reports 49 booked events generating approximately 575,000 total room nights in 2025 (vs. 48 events with 548,000 in 2024). Twenty-one of these events generate rooms on peak of over 2000, while three events expect 6000+ peak rooms. Overall, the timing of the convention events in 2025 is similar to 2024, with the exception of slower business in July, August and September. It’s important to note that the Hynes Convention Center will be closed for renovations from June to August, impacting the Back Bay market.

- Office Market Recovery: Boston’s office market recorded 1.9 million sq. ft. of leasing activity in Q4 2024, with positive quarterly absorption. After 2 ½ years of negative absorption following 2021, the market saw its second consecutive quarter of positive absorption. Availability at year end 2024 remained constant at 22.7% as vacancy rose slightly to 18.1%. Unfortunately, the Cambridge office market faced the same headwinds that have been plaguing office markets across the country. However, Cambridge continues to struggle, with 171,000 sq. ft. of negative absorption (a considerable improvement over 2023 when the market saw 821,000 sq. ft. of contraction) in 2024 and a 21% vacancy rate at end of Q4 2024.

- Evolving Leisure Demand: High-end leisure travelers will drive growth, while price-sensitive travelers may continue to reduce spending. On a positive note, several key events will occur in the City’s shoulder and slow seasons. According to Meet Boston, there are 11 major sporting events planned in the City, with five of these occurring in February and March. Additionally, Meet Boston stated that 80% of the top 10 international markets in 2025 are projected to exceed 2019 visitation levels, garner significant lodging demand. According to current forecasts, consumer spending is expected to slow down in 2025, with most experts predicting moderate growth compared to the previous year.

- Logan Airport Growth: YTD November 2024, Logan Airport served over 40 million passengers (up 6% from 2023), including nearly 9 million international travelers (a 14% increase). Continued growth is expected in 2025.

While ADR is projected to improve, rate growth will decelerate due to fewer compression nights, economic concerns, and Boston’s already high hotel rates compared to other urban markets. Pinnacle’s 2025 projection for the City is presented below.

Click on image below to enlarge:

Challenges Ahead

Despite a positive outlook, several challenges could impact profitability:

- Political & Economic Uncertainty: Potential policy changes affecting travel, labor markets, and tariffs.

- Union Contracts & Wage Pressures: The new agreements that were recently approved will put more pressure on managing wage increases.

- Regulatory Changes: Health and safety ordinances under consideration may raise operational expenses.

- Hynes Convention Center Renovation: Temporary closures will reduce Back Bay room demand.

- Economic Pressures: Inflation, interest rates, and supply costs create uncertainty.

Conclusion

The Boston and Cambridge lodging market is steadily improving while adapting to the post-COVID landscape. Though full recovery remains a few years away, the market demonstrates resilience and is well-positioned for future growth. With strategic planning and investment, Boston’s hospitality sector is set to thrive in the coming years.

October 2, 2024 5:28 pm

Comments Off on The Impact of Natural Disasters on Hotel Occupancy in Florida – by Allison Fogarty For years, I’ve analyzed sharp fluctuations in hotel occupancy levels across several Florida markets, and one recurring explanation has been “disaster recovery.” In regions prone to hurricanes, fires, and floods, disaster recovery can significantly boost demand for hotels, even as some properties suffer damage or destruction. In the aftermath of Hurricane Helene, it’s a timely reminder for lodging developers and analysts that the hospitality industry often experiences contrasting outcomes: while some hotels are devastated, others see a surge in demand.

The Aftermath of Hurricane Helene

Hurricane Helene touched ground on September 26th. Although Hurricane Helene remained offshore by 60 to 80 miles, the destruction it caused was substantial. St. Petersburg Beach, described by local law enforcement as a “war zone,” bore the brunt of the storm’s force. Powerful storm surges—6.5 feet high—were driven by winds clocking in at 130 miles per hour. The surges washed through buildings, carried away vehicles, and left Gulf Boulevard covered in debris, resembling more of a beach than a main road. Several buildings were severely damaged, with homes either destroyed or left in dire condition.

Further up north, the storm’s impact extended into Georgia, Tennessee, and North Carolina, causing catastrophic flooding. Rivers overflowed, bridges were swept away, and cities like Asheville were submerged, leaving communities and vital infrastructure heavily damaged.

Hotels in these affected areas faced severe damage, leading to closures. Floodwaters needed to recede, assessments made, and repairs completed before normal operations could resume. While the damage to hotels will hinder normal business operations, the recovery efforts will create new demand for accommodation. Utility crews, federal and state workers, FEMA teams, and nonprofit organizations will be deployed to assist in the recovery efforts, along with insurance adjusters and contractors. These professionals, along with displaced residents, will need places to stay, which will likely result in elevated hotel occupancy levels in surrounding regions.

Case Study: Hurricane Ian

A recent example of this phenomenon was seen during Hurricane Ian, which made landfall in Cayo Costa, Florida, as a Category 4 hurricane. The storm’s impact was devastating, particularly in Lee County, where over 52,000 structures were damaged, and 72 lives were lost. Entire neighborhoods, particularly in Fort Myers Beach, were nearly wiped out. Prior to the hurricane, this beach town was home to around 6,000 full-time residents, but as of 2024, less than half have returned.

The recovery process has been slow and arduous. It took almost a full year just to clear the storm debris, and rebuilding has been challenging due to shortages of contractors. Many of the buildings that gave Fort Myers Beach its distinct “Old Florida” charm—low-rise structures, built close to the ground—are now gone. This has had a significant impact on the local hotel inventory, which declined by 12% from June 2022 to June 2024.

While the leisure demand in inland areas dropped, it was compensated for by the influx of recovery workers. These included displaced residents, FEMA teams, contractors, and insurance adjusters, all of whom required temporary accommodations. This led to increased occupancy in hotels further inland, pushing occupancy levels well above those seen in 2019, even as coastal hotels remained closed.

Before Hurricane Ian, Lee County’s hotel market was recovering strongly from the COVID-19 pandemic. In 2019, occupancy levels were around 68%, but they climbed to 71% by August 2022, as Florida reopened earlier than many other states, drawing in tourists seeking warm weather escapes. Cruise ships were also inactive during this period, driving even more visitors to Florida. However, after Hurricane Ian struck in September 2022, these numbers fluctuated. Hotel occupancy remained elevated, with a peak at 71.5% in August 2023.

However, as recovery efforts waned and the number of workers decreased, leisure travelers have been slow to return. This is partly because two major tourist destinations, Fort Myers Beach and Sanibel Island, are still recovering. By August 2024, occupancy levels had dropped to 65.6%, falling below 2019 levels.

The Broader Impact of Disasters on Hotel Markets

What happened in Florida is not an isolated event. Similar trends have been observed in other regions affected by natural disasters. For example, in 2020, Oregon experienced a catastrophic fire season, which temporarily boosted hotel occupancy as recovery efforts got underway. Once both the pandemic and the disaster recovery phase subsided, occupancy levels dropped again.

The effects of disasters often extend beyond the immediate areas of impact. When storms approach, evacuation orders are issued, leading to an increase in demand for accommodations in less vulnerable areas. Hotels along Florida’s highways often experience a surge in occupancy as evacuees seek shelter. Additionally, once recovery efforts are underway, hotel demand remains elevated as utility crews, insurance adjusters, and federal response teams continue their work.

Lessons for Hotel Developers

One important lesson for lodging developers and market analysts is to carefully evaluate the reasons behind rapid increases in demand. While natural disasters can lead to temporary spikes in occupancy, these increases are often unsustainable in the long term. Once the recovery phase concludes, demand returns to pre-disaster levels, and occupancy may drop. Investing in or developing new properties based on short-term gains seen during disaster recovery can lead to disappointment when normal market conditions resume.

In conclusion, while natural disasters can devastate communities and businesses, they can also temporarily boost hotel demand. As the case studies of hurricanes like Helene and Ian show, recovery efforts often lead to elevated occupancy levels, particularly in areas just outside of the most affected zones. However, these gains are usually short-lived, and developers must remain cautious about making long-term decisions based on short-term market changes. Understanding the complexities of disaster recovery and its effects on hotel markets is crucial for navigating these unpredictable events.

September 24, 2024 8:20 pm

Comments Off on Boston and Cambridge Lodging Market: Navigating Post-Pandemic Realities and Future Prospects – by Rachel Roginsky, ISHC The Boston and Cambridge lodging market, one of the most vibrant and dynamic in the United States, has undergone significant changes in recent years. These changes, spurred by external factors like the COVID-19 pandemic, economic fluctuations, and evolving consumer preferences, have created a complex landscape for hoteliers and investors alike. This article delves into the current status of the Boston/Cambridge market, examines historical data and trends, and offers short term projections for the future.

Historical Overview: A Market Shaped by External Forces

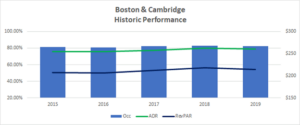

Pre-Pandemic Growth and Resilience (2015-2019)

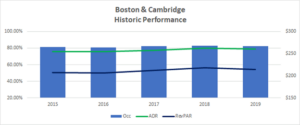

In the years leading up to 2020, the Boston/Cambridge lodging market was characterized by robust growth and strong performance metrics. The market was supported by a thriving economy, with Boston’s position as a leading center for education, healthcare, and technology driving consistent demand for hotel rooms. The local office markets were healthy, the convention calendar was robust, and tourists flocked to the City to visit the abundance of tourist attractions. The Cambridge area, in particular, benefited from its proximity to prestigious institutions like Harvard University and MIT, attracting a steady stream of academic and business travelers, coupled with a thriving office market.

Occupancy rates during this period consistently remained above 80%, reflecting the market’s ability to absorb new hotel supply without significant drops in performance. The introduction of several high-end properties, including boutique hotels and luxury chains, further diversified the market, catering to a wide range of traveler preferences.

Please click on the image below to view:

Source: Pinnacle Perspective

The Disruption of COVID-19 (2020-2021)

The onset of the COVID-19 pandemic in early 2020 brought unprecedented challenges to the lodging industry, and the Boston and Cambridge markets were no exception. Occupancy rates plummeted as travel restrictions and lockdowns took effect, leading to a sharp decline in business, group and leisure travel. Hotels faced significant financial strain, with many reducing operations or closing temporarily.

The impact was particularly severe in the Boston area, where large conventions and events, traditionally major drivers of hotel demand, were canceled or postponed indefinitely. Office workers stayed home given the severe business travel restrictions. Universities converted to School From Home. The lack of international tourists further compounded the problem, as Boston’s historic sites and cultural attractions typically draw significant numbers of visitors from abroad.

Recent Developments: Recovery and Resilience

Gradual Rebound (2022-2023)

As the global situation began to stabilize in 2022, the Boston and Cambridge lodging market showed signs of a gradual recovery. While the road to recovery has been uneven, with occupancy rates remaining below pre-pandemic levels, there have been many positive developments. The return of business travel, although not at full capacity, and the resumption of events have provided a boost to the market.

Please click on the image below to view:

Source: Pinnacle Perspective

Projections: The Lodging Market Continues to Advance

Short-term Outlook (2024-2025)

In the short term, the market is expected to continue its recovery, although at a measured pace. Occupancy rates are not expected to reach their pre-pandemic levels of 81%-82% in 2024 and 2025. There are several key factors that will aid in the continued recovery which include: 1) the return of large-scale events and conventions, which are crucial drivers of demand in the Boston area, 2) slow and steady improvements to the City’s office market, 3) strong leisure demand especially with the more affluent travelers, 4) a number of key events that are scheduled to occur in Boston’s shoulder and slow seasons, and 5) a record-setting number of passengers at Logan Airport. And maybe even another great year for the Celtics and the Bruins!

The ADR is also anticipated to improve, although the increases will be at a decelerating rate. Fewer compression nights, economic issues impacting discretionary spending, and hotel rates that are considered high as compared to other urban markets contribute to the slowing of rate growth.

Please click on the image below to view:

Source: Pinnacle Perspective

Challenges and Risks

Despite the optimistic outlook, there are some risks that could impact on the market’s trajectory. Furthermore, there are a number of challenges facing the local lodging market that could impact hotel profits. Below are a few key challenges and risks:

- Nov. Election – impacts stability local, national and international visitation.

- Union Contract – currently under negotiation with potential to disrupt operations and puts pressure on wages.

- Health and safety ordinance – currently under consideration and could drive up operating costs.

- Hynes renovation -the long-term renovation limits room nights with partial shutdowns.

- Labor shortage – particularly in roles such as housekeeping and food services, remains a persistent challenge that could affect service quality and operational efficiency.

- BCEC – although a record year is expected in 2025, there continues to be less compression given new supply in the Seaport, along with the calendar of events and size of groups on peak.

- Economic issues – inflation, the potential for a recession, higher interest rates, and higher prices for supplies continue to pose uncertainty.

- Limited hotel supply – could impact the ability to sell to groups.

- Leisure travel – leisure demand has plateaued and will potentially be more rate-sensitive.

Conclusion: A Market in Transition

The Boston and Cambridge lodging market is improving while at the same time, adjusting to the new norm in a post covid environment. The market is emerging from the challenges of the past few years with a renewed focus on innovation and adaptability. While the path to full recovery is still a few short years away, the market is showing resilience and is well-positioned to capitalize on new opportunities. The next few years will bring both challenges and opportunities, but with careful planning and strategic investments, the market is set to thrive in a post-pandemic world.

ABOUT THE AUTHOR:

Rachel Roginsky, ISHC, is the owner and founder of Pinnacle Advisory Group. She is based in the firm’s Boston office. Roginsky has more than 40 years of experience in hospitality consulting. In 1991, Roginsky founded Pinnacle Advisory Group. Roginsky provides hospitality operational, investment counseling and advisory services to corporate, institutional, and individual clients on all facets of hospitality real estate. She also serves as board member to numerous hospitality-related organizations and societies, and is a regular guest lecturer at prestigious institutes of higher education. Additionally, Roginsky is an adjunct professor at Boston University School of Hotel Administration. She is widely published and quoted, and is the co-editor and author for Hotel Investments: Issues and Perspectives, a well-regarded book (5 editions) published by the Educational Institute of the American Hotel and Lodging Institute.

September 4, 2024 7:02 pm

Comments Off on Rhode Island Lodging Market Outlook – presented by Kate Mashburn On September 4, 2024, Kate Mashburn presented at the Rhode Island Hospitality Association’s Economic Outlook Breakfast. The lodging presentation included a discussion and analysis of the national lodging market, the Rhode Island lodging market, and data on four submarkets in the state: Providence, Warwick, Newport, and Middletown.

Kate revealed that, on a national level, luxury and upscale hotels and accommodations have experienced continued growth while budget and middle-cost travel is decreasing as consumers are becoming more price-conscious compared to just after the pandemic. Additionally, a survey the National Restaurant Association conducted among restaurant operators indicated increasing concerns about the economy as well as increasingly pessimistic outlooks on general business conditions.

Statewide, the hotel industry is steady, with year-to-date occupancy rates hitting just one percentage point under the national average of 63% for July 2024, with Warwick’s occupancy rate projected to reach up to 69% by the end of 2024. Mashburn attributes this partially to increased activity coming out of T.F. Green Airport.

Meanwhile, on Aquidneck Island, occupancy rates have decreased since 2023 owing to increases in supply, namely the opening of the Gardiner House in September 2023, the Wayfinder hotel’s phased reopening and Newport Harbor Island Resort’s reopening in April 2024.

Kate provided information on the health of the economy, the Rhode Island Convention Center, TF Green Airport, the local office markets, and other factors that influence lodging in the state. For each submarket, Pinnacle prepared projections for 2024 and 2025.

Click on the link below to view or download the presentation:

RI Outlook Presentation 2025 -9.8.24

August 13, 2024 6:13 pm

Comments Off on Outlook 2025 – Rachel Roginsky, ISHC Outlook 2025 presentation given by Rachel Roginsky, ISHC, for the Mass Lodging Association: Providing insight on general economic and lodging trends, the presentation provided attendees with 2024 and 2025 projections for both the Boston suburbs as well as the Boston & Cambridge lodging markets.

Click on the title below to view or download a copy of her presentation.

Outlook 2025 – FINAL – 8.12.24

March 27, 2024 7:21 pm

Comments Off on College & University Hotel Ownership Symposium: Key Takeaways ~ by Rachel Roginsky, ISHC The College & University Hotel Ownership Symposium (CUHOS) convened at Harvard University in early March. The focus of the symposium was to allow college and university employees charged with the planning and administration of their institution’s hotels an opportunity to attend seminars and discussions important to the development and oversight of hotel assets. The biennial event, hosted by Pinnacle Advisory Group at a college or university partner, featured data analysis, perspectives, and insights from expert hotel industry partners with on-campus hotel experience. Previous CUHOS symposia have been hosted by Pinnacle at the University of Notre Dame, Villanova University, and Swarthmore College.

At this year’s event, representatives from 25 colleges and universities attended two days of seminars and networking events to discuss topics including Objectives in Owning a Campus Hotel, The Development Process, Hotel Feasibility, Structuring Your Hotel Deal, Capital Planning, Operating Issues that Impact Top Line Revenues, Legal Issues, Tax Structuring (UBIT), Conference Centers/Learning Centers and Multi-Purpose Space, and Operating Issues that Impact Profits.

A key theme among all of the presenters can be summarized as ‘collaboration and partnership’ at every phase of the project from early planning to the daily activities in the building. Other principal takeaways from this year’s conference are the following:

Capital planning is an issue of key importance to most colleges and universities, according to Gary Avigne, Director of Asset Management for Colleges and Universities at Pinnacle Advisory Group. Most institutions that own a hotel, both as a real estate asset and operating business, seek to invest in the property only when the hotel is originally developed or purchased, or in some cases, re-purposed. Once the hotel is operating, the College (Owner) wants the hotel to be self-sustaining. This suggests the need for a strong focus by the hotel operator and the asset manager on capital planning. Accordingly, in addition to operational oversight and annual strategic planning, university hotel asset managers must provide administrators with development and renovation support to allow university administrators to focus on the institution’s core mission.

The importance of starting the development and renovation projects on the right foot was noted by Harry Wheeler, Principal, JCJ Architecture, reflecting a key concern of many attendees. Engaging early with the design, operations, and management teams, for either a new construction project or a renovation, is critical to developing the correct program, one that aligns with ownership goals, and thus ultimately to the project’s success.

“Universities/colleges are fully aware that a hotel can leave a lasting legacy and make a meaningful contribution to their educational mission, but the challenge most universities face lies in navigating the complex path of planning, programming, and ultimately developing these facilities to meet the needs of their communities,” agreed Kyle Hughey, CEO, Charlestowne Hotels; “It’s been shown that a hotel can be the centerpiece for fostering community, enhancing alumni relations, advancement, and supporting academic and professional events. The benefits are broad as they touch every stakeholder from students to faculty, and extend to athletics, alumni and visiting scholars.” However, “recognizing the need for a hotel is merely the first step. This process demands a specific understanding of academic culture, operational requirements, and financial modeling.” And most institutions require multifaceted help including feasibility guidance, development expertise and an operational partner to deliver an impactful campus hotel, according to Hughey.

Sales and marketing of university hotels can sometimes present unexpected challenges according to a presentation by John Hamilton and Nala Holmes, Acquisitions & Business Development of Pyramid Global. They point out that it is a common misconception that university constituents will naturally support the hotel with their university related business. As operators of several college hotels, Pyramid Global stated: “We learned quickly that there are many users: Deans, professors, recruiting, alumni relations, athletics etc., and that they all need to be sold as if they were a corporate account. The college or university that is able to influence and assist the management company with these users will benefit from a more viable project.” In addition, during the development period, they note that it will ultimately benefit the hotel to “conduct focus groups and solicit input from the many constituents that will ultimately use the hotel. Creating a sense of ownership will ultimately translate to loyalty within the university community.” They also suggest that operator input during the early planning process is key to the ultimate success of a development project that will create a welcoming living room for all University constituents to share, be proud of, and return to time and time again.

Creative pathways to financial sustainability by both looking beyond the institution for demand, but also evaluating how college and university hotel owners engage with their own hotel was the focus of a discussion with John Schultzel, Chief Growth Officer of Olympia Hospitality. He noted that “constantly exploring operating efficiencies that align with existing campus resources” is a must for the hotel operator. Additionally, “campus partners care deeply about the reputational impacts of their hotel operator’s execution, from local buzz about the restaurant to the hotel’s digital footprint. Collaboration and partnership between the operator and the College owner at every phase of the project from early planning to the daily activities in the building is very important. “

As non-profit institutions, colleges and universities have special tax needs, including structuring their ownership of real estate to deal with revenue that could be taxed as Unrelated Business Taxable Income (UBTI), according to Martha Frahm, Tax Partner and Cecilia Gordon, Hospitality Partner at Goulston & Storrs. In almost all circumstances, the revenue from a hotel owned by a college or university is likely to qualify as UBTI. In those circumstances, the educational institution has several options to address the taxable income. One of the most common approaches is to lease the real estate to a third-party that will operate the hotel, however, as hotel leases are comparatively rare in the United States commercial real estate market (as compared to Europe), using a lease raises practical and economic questions that should be addressed up front. They point out that to avoid problems down the road, all options should be discussed early in the process with tax counsel experienced in working with non-profit institutions.

As more colleges and universities study the feasibility of developing hotels on or near their campuses, or seek to renovate and reposition older properties on their campuses, I stressed the importance of understanding the local market, conducting demand research with actual college demand generators, and understanding future plans for the college that are critically important when making a decision to pursue hotel or conference center development. All of the speakers reinforced the importance of effective planning in setting up hotel projects for success both within the university or the broader community.

Rachel Roginsky is the founder and Owner of Pinnacle Advisory Group, a national hospitality consulting practice headquartered in Boston with office throughout the United States. Pinnacle has been assisting colleges and universities with hotel projects for over 35 years.

January 31, 2024 9:35 pm

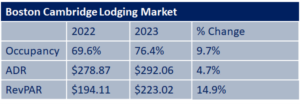

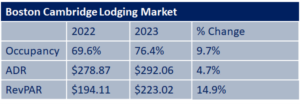

Comments Off on BOSTON/CAMBRIDGE LODGING MARKET – 2023 YEAR END REVIEW, By Rachel Roginsky, ISHC The Boston/Cambridge lodging market ended 2023 at 76.4% occupancy, a 6.8% variance over 2022’s 69.6%. This 6-point increase in occupancy is a result of the market accommodating 8.6% more rooms in 2023 compared to the prior year; 0.6% more rooms occupied as compared to 2019. Seasonality appears to be in sync with what we typically expect for the Boston market. Peak season, May through October, monthly occupancies ranged between 84% and 89%, averaging 86%. The three-month shoulder season, March, April and November, market occupancy averaged 75%. December through February, our slow season, market occupancy averaged 58% in 2023. Finally, in terms of the 2023 market demand mix, and based on data provided by hotel managers in the City, the group, contract, transient leisure, and transient corporate mix was 22%, 6%, 45% and 27%, respectively. This compares to an estimated demand mix for 2022 of 22%, 6%, 42%, and 30%, respectively. Clearly the most significant change was the shift within the transient segment where transient corporate demand increased as the corporate market continues to ramp up from the impact of the pandemic.

Overall, ADR increased by 4.7% in 2023 over 2022. However monthly ADR growth declined from very high rates growth in the early part of the year. In the first five months of 2023, room rates grew at an average rate of 12.8%. This compares to an average growth rate of 4.0% for the remaining 7 months of 2023. In fact during the summer months (June/July/August) rate growth slowed even more (an average of 2.6%) which can be attributed to leisure travelers considering alternative locations and not willing to pay significantly more for rooms in the Boston market.

With both strong occupancy and room rate, the Boston/Cambridge RevPAR reached $223.03 in 2023, up 14.9% from the 2022 level, and surpassing 2019 levels by 4.0%. Clearly hotel operators and owners in the City are more optimistic and most believe that the subject lodging market will continue its upward trajectory.

Presented in the table below are the year-end 2023 vs. 2022 statistics for the Boston/Cambridge lodging market.

click on image below to enlarge:

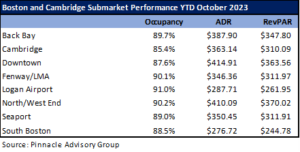

While the 2023 occupancy and ADR for the City have been strong, the actual performance for hotels within the submarkets differs. For example, if we look at geographic submarkets, the Logan Airport submarket achieved the highest occupancy in 2023, reaching 84.6%. This submarket also garnered the strongest rate growth, increasing 10.2% in 2023 compared to 2022. With room rates lower in this submarket as compared to other submarkets, the 2023 RevPAR of $188.95 placed this submarket as the 2nd lowest in the City. The second strongest geographic areas in terms of occupancy were Fenway/Longwood Medical Area (LMA) and North End/West End, both ending the year at approximately 80%. Cambridge had the lowest annual occupancy, at 71.5%. Pre-covid, the Cambridge lodging market performed at an occupancy level slightly below the overall Boston/Cambridge lodging market (2019: Cambridge 81.75% vs Total Boston/Cambridge 82.5%). Unfortunately the Cambridge submarket is still ramping up. According to CBRE’s fourth-quarter Cambridge office report, office demand from tech companies in Cambridge contracted by more than 85% from 2019 to the end of last year. In terms of RevPAR, the top three submarkets with the highest RevPAR were North End/West End, Downtown and Back Bay.

Looking at operating performance by rate tier also shows varied results. For example, occupancy in the luxury tier in 2023 was only 58.7%. While this tier typically operates with lower occupancy, it clearly is taking more time for the ultra-high rated hotels to gain traction. Furthermore, our newest hotel, Raffles, which opened towards the end of 2023, will add for luxury inventory to the City in 2024. With respect to room rate, the ADR for this rate tier was $596.45, a 2.9% decline from 2022. Regardless of the drop in ADR, the luxury tier RevPAR ended the year at $344.59, a 16.7% increase over prior year performance. The two lower rate tiers in the City achieved the highest occupancy (79%) with room rates and RevPAR averaging approximately $234.84 and $186.82, respectively.

With a very good year behind us, there is much to be optimistic about as we move into 2024 although the hospitality industry has become accustomed to surprises. Nevertheless, all signs point to a healthier lodging market in Boston/Cambridge in 2024.

About the Author

Rachel J. Roginsky, ISHC, is the Owner and Founder of Pinnacle Advisory Group. She is based in the firm’s Boston office. Ms. Roginsky has more than 40 years of experience in hospitality consulting. Ms. Roginsky is an appointed board member of The Cornell Center for Real Estate and Finance (CREF), and is the current Chair for Boston University School of Hospitality Administration’s Real Estate Advisory Council (REAC). She also serves as a board member to numerous hospitality-related organizations and societies, and is a regular guest lecturer at prestigious institutes of higher education. Additionally, Ms. Roginsky is an adjunct professor at Boston University. She is widely published and quoted, and is the co-editor and author for Hotel Investments: Issues and Perspectives, a well-regarded book (5 editions) published by the Educational Institute of the American Hotel and Lodging Institute.

December 22, 2023 7:01 pm

Comments Off on A Year In Review: How 2023 Exceeded Expectations and Optimism for 2024 – by Rachel Roginsky, ISHC The article below was featured in the December 22, 2023 issue of the New England Real Estate Journal, and authored by Rachel Roginsky, ISHC:

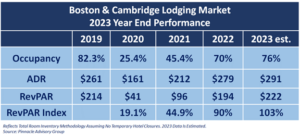

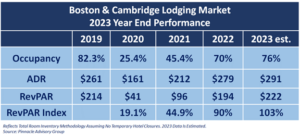

The Boston & Cambridge (“City”) lodging market recorded an occupancy of 45% in 2021, only 55% of its performance in 2019. Last year, occupancy increased to 70%, representing an 85% index to 2019. The City’s yearend 2023 occupancy is estimated to be 76%, a 92% index. It’s clear that lodging demand continues to gain strength. More importantly, if we account for actual demand, by the end 2023, the Boston market will accommodate 8% more roomnights than in 2022 and slightly more room nights as compared to 2019.

The City’s ADR has recovered from the pandemic at a faster pace than its occupancy, climbing to $291 in 2023, a 4.5% increase over 2022 and a 12% premium to 2019 levels. However, it’s worth noting that ADR improvements in 2023 have moderated throughout the year, while occupancy continued to climb month over month. For example, for the first 6 months of 2023, ADR increased an average of 11% for the same time period in 2022, as compared to 3.7% (est.) for the last 6 months of 2023.

The market’s revenue per available room (RevPAR) in 2022 and 2023 was at 90% and 103%(est.), respectively, index relative to its RevPAR in 2019. By comparison, the U.S. lodging market’s RevPAR in 2022 and 2023 was 107% and 112% (est.) when indexed to 2019. While still below the recovery of the entire US lodging market, the City continues its upward trend. The expectation is that 2024 will feel more like 2019 in terms of overall travel in the Boston market.

Presented below is our 2023 forecast for the Boston/Cambridge lodging market compared to the annual performance pre-covid (2019).

click on the image below to enlarge:

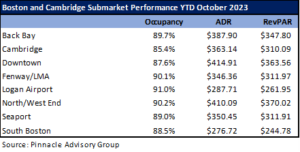

Submarket Performance

Pinnacle Advisory Group tracks market statistics by submarkets. Presented below is a table showing the October YTD 2023 occupancy, room rate, and RevPAR by submarket.

click on image below to enlarge:

For the first 10 months of 2023, both occupancy and ADR in all submarkets have shown strong growth over 2022. Occupancy for the Boston/Cambridge market increased from 71% in 2022 to 78% for October YTD 2023. The Logan (airport) and Fenway/LMA submarkets continue to lead in occupancy. The higher occupancy at the airport corresponds to the significant improvement in air traffic at Logan. The Fenway submarket benefits from the strength of the City’s medical industry. While Cambridge occupancy increased 9% this year, this submarket recorded the lowest submarket occupancy. University demand is strong, but lab space and associated biotech industry is still recovering.

New Supply

Between 2015 and 2022, the lodging supply in Boston/Cambridge increased 3%, compounded annually. Even with strong supply growth, and without taking into consideration market occupancy in 2020 and 2021, the City’s occupancy averaged 80% exemplifying the strength of the lodging market. New supply growth for 2023 and 2024 will be minimal. In 2023 supply will decline 1.1%; in 2024 it will increase 1.1%. The lack of new supply will continue to aid in the recovery of the market from the impact that the pandemic had on travel.

2024 – Momentum Continues

Here’s our perspective on the City’s lodging market for 2024:

- Convention and Group Demand – This segment of demand comprises approximately 23% of total demand in the City. According to Signature Boston, the Boston Convention and Exhibition Center will generate approximately 500,000 room nights in 2024, which will be a record year for this venue. However, the Hynes Convention Center may only generate around 120,000 room nights, potentially only ½ of the room nights generated in 2023. This anticipated poor performance is due to the combination of a stop-sell order that was in place for 5 years, coupled with extensive, on-going renovation plans which will keep this Center dark during certain periods of the year.

- Corporate Transient Demand – We believe that corporate transient demand will continue its slow and steady recovery from the pandemic, based on our research into local demand trends. The local office brokerage community believes that moderately increasing demand for office space in the city provides a reason for cautious optimism for 2024, although nearly 1.5 million s.f. of occupancy losses in Q3 2023 drove vacancy rates to 20-year highs. However, although employment in traditional office jobs increased over the last twelve months across all sectors in Greater Boston, we don’t yet know what specific companies will do in 2024 as it relates to their in-office attendance policies and/or their travel budgets.

- Leisure Demand – Leisure demand is softening as the pent-up travel demand that resulted from the pandemic has waned, and as leisure travelers opt to visit new locations or travel abroad. We believe that 2022/2023 was the time frame when leisure demand peaked in the City following the recovery from the pandemic.

- Average Daily Room Rate (ADR) – We know that the pace of room rate growth is slowing as compared to the significant ADR rate growth experienced in 2021 (up 32% from prior year), 2022 (up 31% from prior year) and 2023 (up an estimated5% from 2022). For example, for the five months of 2023, ADR increased an average of 12.7% over 2022, while during the five-month period of July through October of 2023, the ADR increased 3.7% compared to the same five months of 2022.

- New Supply – We know that new supply growth in Boston/Cambridge will remain low in 2024 with supply increasing 1% over 2023; and that in 2023 the city’s supply of hotel rooms declined from 2022.

Of course, no one can be 100% certain of all the factors that will influence the Boston lodging market’s ultimate performance. Providing projections is a risky business.

- Risks – A number of national and global issues will impact the lodging market, including the local Boston market. Examples of issues that present risk to the 2024 projections include rising global geopolitical concerns, inflation, a persistent skittish economic environment, challenging consumer confidence, labor shortages, and continued supply chain constraints.

With these factors in mind, Pinnacle believes that demand will improve in the Boston/Cambridge lodging market, and room rates will increase. Our expectations for demand growth, coupled with limited new supply in 2024, results in a projection of 78% for year end 2024 occupancy.

Presented below is Pinnacle’s 2024 forecast for Boston/Cambridge: (click on image to enlarge)

There is much to be optimistic about as we move into 2024 although the hospitality industry has become accustomed to surprises. In addition to projections that have risk, local hotel owners and operators will continue to operate in a challenging labor market which has created wage pressures and increased operating costs. Nevertheless, all signs point to a healthier lodging market in 2024.

To download a copy of the article in its entirety, click on the link below:

NEREJ 12.22.23

November 15, 2023 9:32 am

Comments Off on Boston/Cambridge Lodging Market – Outlook is for Positive Growth for 2024, by Rachel Roginsky, ISHC After spending the last 32 years tracking and analyzing the Boston/Cambridge (“the City”) lodging market, Pinnacle Advisory Group is quite comfortable forecasting top line (occupancy and ADR) revenue for the City. But projecting the future with precision can be complicated. Here’s our perspective on the City’s lodging market for 2024:

- Convention and Group Demand – This segment of demand comprises approximately 23% of total demand in the City. According to Signature Boston, the Boston Convention and Exhibition Center will generate approximately 500,000 room nights in 2024, which will be a record year for this venue. However, the Hynes Convention Center may only generate around 120,000 room nights, potentially only ½ of the room nights generated in 2023. This anticipated poor performance is due to the combination of a stop-sell order that was in place for 5 years, coupled with extensive, on-going renovation plans which will keep this Center dark during certain periods of the year.

- Corporate Transient Demand – We believe that corporate transient demand will continue its slow and steady recovery from the pandemic, based on our research into local demand trends. The local office brokerage community believes that moderately increasing demand for office space in the city provides a reason for cautious optimism for 2024, although nearly 1.5 million s.f. of occupancy losses in Q3 2023 drove vacancy rates to 20-year highs. However, although employment in traditional office jobs increased over the last twelve months across all sectors in Greater Boston, we don’t yet know what specific companies will do in 2024 as it relates to their in-office attendance policies and/or their travel budgets.

- Leisure Demand – Leisure demand is softening as the pent-up travel demand that resulted from the pandemic has waned, and as leisure travelers opt to visit new locations or travel abroad. We believe that 2022/2023 was the time frame when leisure demand peaked in the City following the recovery from the pandemic.

- Average Daily Room Rate (ADR) – We know that the pace of room rate growth is slowing as compared to the significant ADR rate growth experienced in 2021 (up 32% from prior year), 2022 (up 31% from prior year) and 2023 (up an estimated 4% from 2022). For example, for the first three months of 2023, ADR increased an average of 13% over 2022, while during the three months of July, August and September of 2023, the ADR increased 2.9% compared to the same three months of 2022.

- New Supply – We know that new supply growth in Boston/Cambridge will remain low in 2024 with supply increasing 1% over 2023; and that in 2023 the city’s supply of hotel rooms declined from 2022.

Of course, no one can be 100% certain of all the factors that will influence the Boston lodging market’s ultimate performance. Providing projections is a risky business.

- Risks – A number of national and global issues will impact the lodging market, including the local Boston market. Examples of issues that present risk to the 2024 projections include rising global geopolitical concerns, inflation, a persistent skittish economic environment, challenging consumer confidence, labor shortages, and continued supply chain constraints.

With these factors in mind, Pinnacle believes that demand will improve in the Boston/Cambridge lodging market, and room rates will increase. Our expectations for demand growth, coupled with limited new supply in 2024, results in a projection of 78% for year end 2024 occupancy.

Presented below is Pinnacle’s 2024 forecast for Boston/Cambridge:

There is much to be optimistic about as we move into 2024 although the hospitality industry has become accustomed to surprises. In addition to projections that have risk, local hotel owners and operators will continue to operate in a challenging labor market which has created wage pressures and increased operating costs. Nevertheless, all signs point to a healthier lodging market in 2024.

About the Author

Rachel J. Roginsky, ISHC, is the Owner and Founder of Pinnacle Advisory Group. She is based in the firm’s Boston office. Ms. Roginsky has more than 40 years of experience in hospitality consulting. Ms. Roginsky is an appointed board member of The Cornell Center for Real Estate and Finance (CREF), and is the current Chair for Boston University School of Hospitality Administration’s Real Estate Advisory Council (REAC). She also serves as a board member to numerous hospitality-related organizations and societies, and is a regular guest lecturer at prestigious institutes of higher education. Additionally, Ms. Roginsky is an adjunct professor at Boston University. She is widely published and quoted, and is the co-editor and author for Hotel Investments: Issues and Perspectives, a well-regarded book (5 editions) published by the Educational Institute of the American Hotel and Lodging Institute.

9:00 am

Comments Off on Updated 2024 Forecast and New Supply for Boston/Cambridge – by Rachel Roginsky, ISHC The Meet Boston organization asked for an update to our 2024 Boston/Cambridge lodging market forecast.

On November 15, 2023, Rachel Roginsky, ISHC, presented the enclosed deck.

Please click on the link below to view the presentation:

Boston Cambridge Lodging Market – 2024 projections as of 11.15.23