Author Archives: Amanda Wiggins

September 8, 2022 12:37 pm

Comments Off on Rhode Island Lodging Market Outlook – By Rachel Roginsky, ISHC On September 7, 2022, Rachel Roginsky presented at the Rhode Island Hospitality Association’s Economic Outlook Breakfast. Her topics included both the national lodging market, as well as the Rhode Island lodging market including discussions on Providence, Warwick, Newport and Middletown. Similar to national industry performance, the lodging markets in Rhode Island are in varying stages of a recovery from the effects of the pandemic.

To view the entire presentation, please click on the link below:

RI Outlook Presentation – FINAL

August 26, 2022 1:53 pm

Comments Off on Outlook 2023 – Rachel Roginsky, ISHC, and Sebastian Colella Rachel Roginsky and Sebastian Colella participated in the Massachusetts Lodging Association’s annual Outlook event which took place in August at the Boston Convention & Exhibition Center (BCEC). Providing insight on general economic and lodging trends, the presentation provided almost 300 attendees with 2022 and 2023 projections for both the Boston suburbs as well as the Boston & Cambridge lodging markets. The presentation, which can be found on Pinnacle’s website, explains why Pinnacle is forecasting the Boston suburbs to return to pre-pandemic performance in 2023, and why the Boston/Cambridge lodging market will reach a RevPar penetration index of 97% in 2023.

Please click on the link below to view the entire presentation:

Final – Outlook 2023

June 21, 2022 8:47 pm

Comments Off on Hospitality Leaders Join Forces to Award Inaugural Celebrating Diversity Scholarship

From left to right: Chandler Williamson, Senior at North Carolina Central University; Rachel Roginsky, ISHC, Owner of Pinnacle Advisory Group Inc.; and Morgan Best, Junior at Virginia State University.

New York — June 21, 2022 — This month, hospitality leaders across the industry joined forces to launch the first-ever Celebrating Diversity Scholarship – paving the way for two students to attend the 44th Annual NYU International Hospitality Industry Investment Conference.

In its inaugural year, the Celebrating Diversity Scholarship awarded the two student recipients:

Complimentary registration to the NYU International Hospitality Industry Investment Conference as a member of the student volunteer team

- $1,200 utilized for travel and associated expenses

- Accommodation at the New York Marriott Marquis, provided by Marriott International for the conference dates, June 5-7

“To work and learn from those that are top in the industry and be on the cutting edge of what the future holds for the hospitality industry would be priceless,” said scholarship recipient Morgan Best, a hospitality management junior at Virginia State University. The knowledge I could gain from this experience could never be duplicated in a classroom.”

“In my future career, I plan on contributing to making hospitality a more diverse and inclusive industry through my diversity of thought,” said scholarship recipient Chandler Williamson, Hospitality & Tourism Administration major at North Carolina Central University. “Over my experiences, I have learned to appreciate differences. These differences are in perspective, ideas, cultures, and people’s unique contributions. My goal is to become a business developer and one way they succeed is by weighing all the options of feasibility and delivering a product that will meet many needs for all different backgrounds.”

“The Celebrating Diversity Scholarship is the result of a special collaboration among NYU, The AHLA Foundation, ISHC and myself and my co-author Lori Raleigh. We are thrilled that we could bring this group together and offer these students a once-in-a-lifetime opportunity,” said Rachel Roginsky, ISHC, owner & principal of Pinnacle Advisory Group Inc. and co-editor and author Hotel Investments: Issues & Perspectives.

Proceeds from Hotel Investments: Issues & Perspectives were used to help fund the Celebrating Diversity Scholarship. Over the years there have been five editions of the book—with nearly 100 leaders and industry experts in the industry having served as contributing authors. The book has been used extensively as part of the Hospitality program curriculum at many leading Colleges and Universities.

For more information:

Andrea Belfanti

CEO

ISHC

+1 678-973-2242

abelfanti@ishc.com

About ISHC

The International Society of Hospitality Consultants is truly The Leading Source for Global Hospitality Expertise, represented by over two hundred of the industry’s most respected professionals from across six continents. Collectively, ISHC members provide expert services in over fifty functional areas and have specialized skills in virtually every segment of the hospitality industry. ISHC is dedicated to promoting the highest quality of professional consulting standards and practices for the hospitality industry. Candidates undergo a rigorous screening process, ensuring that all ISHC members have a reputation of integrity and are qualified by their experience, training and knowledge to develop and express sound judgment on industry issues. Additional information about the organization, along with a directory of ISHC members, is available on the ISHC website at ishc.com.

About The AHLA Foundation

The AHLA Foundation, the charitable giving arm of the American Hotel & Lodging Association, is dedicated to helping people build careers, improve their lives, and strengthen the lodging industry. From lifting individuals out of poverty and connecting them with a life-long career in the industry to providing certifications to promote current hotel employees into leadership positions, the Foundation’s programs are changing the industry by changing lives. We are committed to elevating, educating, and empowering individuals and the public on the industry’s story of opportunity and advancement. The Foundation is funded solely by contributions from generous individuals and companies who want to give back to the hotel industry and ensure a successful future. Learn more at www.ahlafoundation.org.

About the NYU SPS Jonathan M. Tisch Center of Hospitality

The NYU School of Professional Studies Jonathan M. Tisch Center of Hospitality, now celebrating more than 25 years of academic excellence, is a leading center for the study of hospitality, travel, and tourism. Founded in 1995, the Tisch Center was established in response to the growing need for hospitality and tourism undergraduate and graduate education. Its cutting-edge curricula attract bright, motivated students who seek to become leaders in their fields.

Through its undergraduate degree in hotel and tourism management, its graduate degrees in hospitality industry studies, tourism management, and event management; a plethora of Professional Pathways programs; and its world-renowned hospitality investment conference, students gain the knowledge and the skill sets that enable them to manage change, to communicate, to thrive in complex work environments, and to advance the businesses of hospitality, travel, and tourism. The Tisch Center recently launched the Hospitality Innovation Hub (HI Hub), which will foster entrepreneurship and creative solutions for the industries it serves. The state-of-the-art facilities offer students, start-ups, established industry partners, and investors opportunities to learn, discover, innovate, and invest.

For more information about the NYU SPS Jonathan M. Tisch Center of Hospitality, visit sps.nyu.edu/tisch.

June 8, 2022 8:25 pm

Comments Off on Pinnacle Advisory Group at the Greater Hartford Area Realtor Commercial Conference – presented by Gary Avigne On June 8 Gary Avigne represented Pinnacle Advisory Group at the Greater Hartford Area Realtor Commercial Conference in West Hartford, CT, sponsored by Goman and York. This is the third year Gary has been on the panel as the hospitality sector expert. Pinnacle’s presentation, attached, was well-received. Perhaps next year the hotel industry performance will be better than that of the industrial warehouse segment, a real estate darling at the moment.

Please click on the link below to view the presentation:

UConn-GHAR 6.8.22 – PAG revised

May 31, 2022 9:00 pm

Comments Off on Boston & Cambridge Lodging Market – Q2 2022 Update, presented by Sebastian Colella Sebastian Colella provided members of the Massachusetts Lodging Association (MLA) with an update on trends across the State and the Boston MSA, along with revised 2022 projections for the Boston & Cambridge lodging market. The presentation is a precursor to the MLA’s annual Outlook event which will be held in August and feature Pinnacle, along with the Massachusetts Convention Center Authority, and The Greater Boston Convention and Visitors Bureau, among others.

Please click on the link below to view the presentation slides:

Boston Cambridge Lodging Market May 2022

February 22, 2022 1:39 pm

Comments Off on Boston & Cambridge Lodging Market Recovery to Gain Momentum in 2022 – by Sebastian Colella Despite a slow start to the New Year, the Boston & Cambridge lodging market should pick up speed as spring rounds the corner. Like many urban gateway cities, the market has struggled in its recovery from the negative effects of the pandemic. While leisure demand came roaring back once many of the government mandates and restrictions were lifted in the spring of 2021, corporate and group travel was hampered through much of the year. Furthermore, international travel was subject to federal travel restrictions preventing visitors from some of Boston’s largest feeder markets, specifically Canada and Europe. Despite sizeable year-over-year increases in occupied roomnights and average daily rate (ADR), the market’s performance was well short of pre-pandemic levels. Given the trajectory of the recovery in the second half of 2021 however, owners and operators are optimistic that the favorable trends will continue through 2022, albeit a bit later and at a slower pace than they would like.

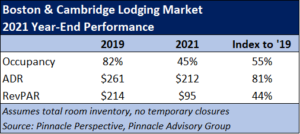

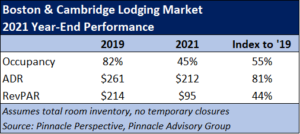

2021 Retrospective

The Boston & Cambridge lodging market had an occupancy of 45% in 2021, only 55% of its level in 2019. The market’s ADR has recovered at a faster pace than its occupancy and reached $212, an 18% discount to 2019 levels. As a result, the market’s revenue per available room (RevPAR) was only 44% of its level in 2019. By comparison, the U.S. lodging market’s RevPAR in 2021 was 81% when indexed to 2019 and the country’s top-25 markets reached 64%, according to STR. Through year-end 2021, the overall Boston market ranks as the fourth slowest market in the recovery behind San Francisco, New York City, and Washington DC.

click on image below to enlarge:

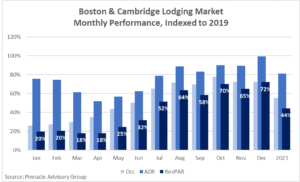

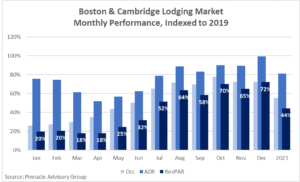

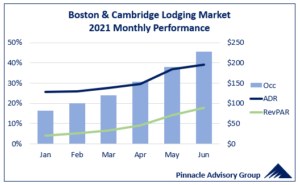

A Late Start

The recovery did not begin to take shape in Boston until late spring and as a result, year-end results are somewhat misleading when gauging the market’s recovery and potential trends moving into 2022. In the first half of 2021 the market’s RevPAR was $47, just 23% of its level in 2019. This increased to 63% for the second half of the year as RevPAR reached $142. The below table shows the market’s performance metrics, occupancy, ADR and RevPAR, indexed to 2019 levels as a measure of its recovery to pre-pandemic levels.

click on image below to enlarge:

As evident in the 2021 monthly performance when compared to 2019, RevPAR began to recover as the state reopened with the ending of the State of Emergency which correlated with the region’s seasonal patterns for leisure travel. Despite the Delta and Omicron variants which delayed the expected return to offices and an increase in corporate lodging demand, the market benefitted from leisure-oriented events in the fall which included the Laver Cup, the rescheduled Boston Marathon, Red Sox playoffs, among other events. Additionally, the city’s two convention centers hosted multiple events and citywides in the second half of the year. Although these events did not make up for the lack of corporate demand, the third and fourth quarter performance helped occupancy inch closer to pre-pandemic levels. When considering the declines in demand and its volatility, operators have been successful in maintaining ADR. The market’s ADR index remained above 80% over the course of the second half of the year and reached 99% in December, meaning its rate was just 1% less than its level in December 2019.

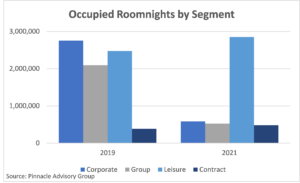

A Shift in Mix

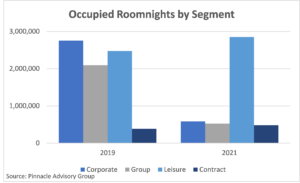

The market accommodated 4.4 million roomnights in 2021, 42% less than its level in 2019. Leading up to the pandemic, the market’s reliance across its three primary demand segments, corporate transient, group, and leisure, was considered a strength. However, with dramatic declines in both corporate and group, the market has seen a significant shift in its demand mix, relying largely on leisure demand.

click on image below to enlarge:

When compared to 2019, the corporate and group segments were down 77% and 72% respectively in 2021. Alternatively, the leisure segment surpassed 2019 levels, exceeding it by over 10%. The market’s contract demand, historically made up of mostly crew demand and by far its smallest segment, now includes a fair amount of rooms being used by colleges and universities for housing students, increased 27% over its 2019 levels.

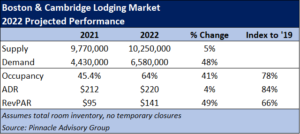

Outlook for 2022

The Omicron variant, and Boston’s vaccine mandate which followed, combined with slowing economic growth, has negatively impacted the start of the year for the lodging market. As a result, these first winter months look to bring another slow start. The good news is that no matter how long the winter, spring is sure to follow. Hotel owners and operators are still hopeful that renewed optimism driven by slowing case counts and the momentum of the market’s recovery in the second half of 2021 will continue as we move forward into 2022.

Pinnacle Advisory Group has projected the recovery of corporate demand to begin to accelerate in Q2, ultimately reaching 60% of its 2019 level. Driven largely by a strong pace at the convention centers and the opening of international travel, group demand is projected to outpace corporate transient and reach approximately 70% of its pre-pandemic level. Leisure travel is expected to grow even further from the levels achieved in 2021 as inbound international traffic ramps back up and the region hosts events which haven’t been held since 2019 as well as new events such as golf’s U.S. Open Championship. Lastly, hotels are expected to continue contracts with local colleges and universities through the spring semester. Matched with month-over-month gains at Logan Airport, contract demand is projected to maintain levels above those experienced in 2019.

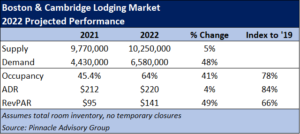

Based on these segmented growth rates, Pinnacle Advisory Group has projected demand to increase 48% from 2021. Although the growth in rooms supply is expected to slow in 2023 and 2024, the market’s room inventory will increase almost 5% in 2022, its largest increase in six years. Based on these supply and demand forecasts, the market is expected to have an occupancy of 64% in 2022. Average daily rate is projected to continue its trajectory seen in the second half of 2021 and increase 4%, reaching $220. The current inflationary environment should provide additional pricing power and help mitigate the negative impacts as corporate and group demand is layered into a market which benefitted last year from mostly high rated leisure.

Although the projected RevPAR of $141 is a 49% increase from last year, it is still approximately 33% less than its pre-pandemic levels.

click on image below to enlarge:

As outlined, Pinnacle Advisory Group’s projections for the Boston & Cambridge lodging market assume a continued, slow recovery in corporate transient and group lodging demand and a heavy reliance on leisure. Two years into the pandemic, ADR growth is expected to slow as demand becomes the driver in the recovery to pre-pandemic performance metrics. While the strength of the leisure market contributed to the ADR growth in 2021, significant growth rates in ADR are not expected to occur again until the market has a solid base of group and a reliable flow of corporate transient through much of the year.

While there is much to be optimistic about as we move into 2022, the hospitality industry has become accustomed to surprises. In addition to limited and volatile lodging demand, hotel owners and operators have managed both a challenging labor market and supply chain issues which have created wage pressures and increased operating costs. It is unlikely that we’ll close the book on the pandemic in the near term, but the receding case counts across the U.S. and other countries are encouraging signs for people to make up for lost time and travel, meet, and conduct business.

September 22, 2021 2:15 pm

Comments Off on AHLA Massachusetts Hotel Conference – by Rachel Roginsky, ISHC On September 22, 2021, Rachel Roginsky was a key note speaker at the AHLA Massachusetts Hotel Conference, On The Road Event. The presentation provided data on historical lodging performance for each state in New England, as well as the statistics for the recovery in 2021. In addition, she addressed market trends and explained how these trends will impact the future lodging performance in New England. According to Ms. Roginsky, the recovery in New Hampshire, Vermont, Rhode Island, and Maine is being driven by the leisure segment. These travelers are paying premium prices, staying longer, requesting upgraded amenities, and travelling both weekends and weekdays. The urban centers in these states are also benefiting from leisure demand. On the flip side, Ms. Roginsky noted that Massachusetts and Connecticut are enduring a much slower recovery given the significant reliance on specific demand segments that have yet to return – corporate transient, convention group, and international travel.

Click on the link below to view the presentation:

AHLA FINAL Presentation

September 9, 2021 12:03 pm

Comments Off on Rhode Island Lodging Market Outlook – by Rachel Roginsky, ISHC On Sept 9, 2021, Rachel Roginsky presented at the Rhode Island Hospitality Association’s Economic Outlook Breakfast. Her topics included both the national lodging market, as well as the Rhode Island lodging market including discussions on Providence, Warwick, Newport and Middletown. Similar to national industry performance, the lodging markets in Rhode Island are in varying stages of a recovery from the effects of the pandemic. Also similar to the national lodging industry, the leisure and drive-to markets are driving the recovery in Rhode Island, while the urban centers are being hindered by slower growth in corporate transient and the group/convention industry.

Click on the link below to view the presentation:

Rhode Island Hospitality Presentation 2021 – FINAL

August 5, 2021 2:01 pm

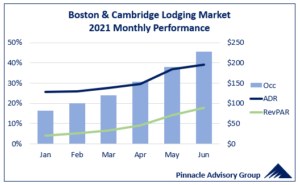

Comments Off on The Boston & Cambridge Lodging Market’s Recovery Projected to Accelerate into 2022 – by Sebastian Colella Despite uncertainties surrounding corporate travel and the return to the office, as well as the Delta variant and the potential for mask mandates and other state or federal restrictions, the Boston & Cambridge lodging market continues to climb a wall of worry. Driven primarily by domestic leisure travel, the market has experienced strong month-over-month gains in demand and average daily rate (ADR) since March.

Click on image below to enlarge:

Although the market has experienced considerable gains the last three months it still lags the United States as a whole and almost every other top-25 market in recovering to pre-pandemic levels. Through June, Boston ranks as the third slowest market to recover among top-25 markets, behind only New York City and San Francisco, according to STR. The Boston & Cambridge lodging market’s occupancy was 46% in June 2021, its strongest occupancy all year yet only half of its level in June 2019. Despite month-over-month gains in ADR since January, market ADR is down approximately 38% to 2019. As a result, the Boston & Cambridge lodging market’s June revenue per available room (RevPAR) of $47 is 77% less than it was just two years earlier.

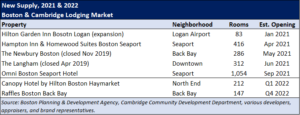

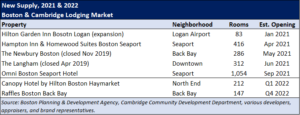

Due in part to its smaller size, the dynamics of the Boston & Cambridge lodging market have proven to be delicate as it relates to increases to its supply. In 2021, the market will welcome over 2,000 new rooms, including the 1,054-room Omni Boston Seaport Hotel, resulting in a supply increase of over 4.0%. As these rooms continue to come online in 2022, two additional hotels are expected to open increasing supply another 5.0%. Over the last 25 years, the market’s supply has increased 2.5% on a compound annual basis so back-to-back gains in supply of this size are an added headwinds the market will face as it recovers from the pandemic.

Click on image below to enlarge:

Through June, hotels have relied primarily on leisure demand with certain submarkets, such as Fenway/Longwood and North/West End, benefiting the most. There has been slow growth in business transient since the spring with notable increases in volume in July. Since the State’s reopening in May, weddings and other social functions have proven to be resilient while corporate meetings, although smaller, have started to take place in recent months. The Boston Convention & Exhibition Center and the Hynes Convention Center have numerous events scheduled between July and yearend including five citywides. When considering these trends, combined with the unique sports events being hosted this fall including the Laver Cup, the rescheduled Boston Marathon, the Head of the Charles, NCAA Fenway Bowl Game, as well as the possibility for an extended Red Sox season, the Boston market is well positioned for continued improvement into Q3 and Q4 of 2021.

Assuming Massachusetts and the City of Boston remain without added restrictions due to a late summer or fall COVID-19 surge, Pinnacle has projected occupancy to reach 41% in 2021 and ADR to increase 20% over 2020. The resulting RevPAR of $80 in Boston & Cambridge is 37% indexed to its 2019 level.

Click on image below to enlarge:

Pinnacle has forecasted trends to continue through 2022. Corporate demand, with the exception of international, is expected to see continued growth as companies return to offices and domestic travel becomes more commonplace among larger companies. Growth in group demand is expected to outpace corporate demand in 2022. Many events from the last 18 months have been rescheduled for 2022, the convention calendar’s citywide and roomnights are comparable to 2019, and SMERF related group is expected to remain consistent. Leisure travel was the lone bright spot in 2021 and it is assumed it will remain strong through 2022 with an extended season, longer weekends, and increased length of stays. Assuming international travel begins to return in early 2022, specifically key markets such as Canada and Europe, the market would benefit from a second round of pent-up corporate and leisure demand from an international demographic.

Pinnacle has projected the Boston & Cambridge lodging market to have an occupancy of 66% in 2022 with a 22% increase to ADR. The market’s RevPAR of $155 is approximately 72% indexed to 2019.

Click on image below to enlarge:

Rachel Roginsky, Principal, and Sebastian Colella, Vice President, presented Pinnacle Advisory Group’s projections for the Boston Suburbs and the Boston & Cambridge lodging markets at this year’s Massachusetts Lodging Association’s Annual Outlook event on July 29, 2021. The full presentation can be found here.

July 29, 2021 11:42 am

Comments Off on Outlook 2022 – Rachel Roginsky, ISHC Click on the title below to view or download the Outlook 2022 presentation given by Rachel Roginsky, ISHC, for the Mass Lodging Association:

FINAL – Outlook 2022